Banking Issues in Focus provides an in-depth analysis of topical banking issues. These articles range from timely analysis of economic and banking trends at the national and regional level that may affect the risk exposure of FDIC-insured institutions to research on issues affecting the banking system and the development of regulatory policy.

In the past, these articles were featured in FDIC Quarterly Volumes.

Recent Articles

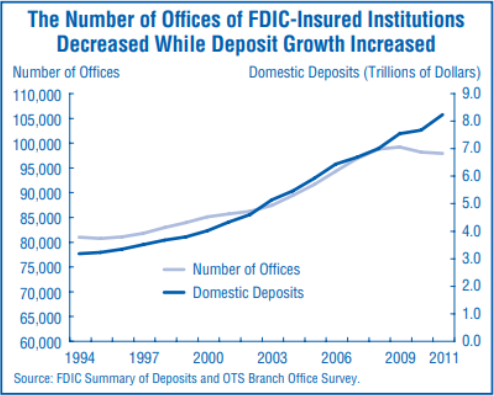

Highlights from the 2011 Summary of Deposits

By Andrew Carayiannis (2011)

Each year as of June 30, the FDIC surveys each FDIC-insured institution to collect information on bank and thrift deposits and operating branches and offices. The resulting Summary of Deposits (SOD) is a valuable resource for analyzing deposit and office trends as well as domestic deposit market share. This article highlights findings from the 2011 SOD.

The Orderly Liquidation of Lehman Brothers Holdings Inc. Under the Dodd-Frank Act

2011

On September 15, 2008, Lehman Brothers Holdings Inc. filed for bankruptcy. The disorderly and costly nature of the bankruptcy—the largest, and still ongoing, financial bankruptcy in U.S. history—contributed to the massive financial disruption of late 2008. In this article FDIC staff examine how the government could have structured a resolution of Lehman Brothers under the orderly liquidation authority of Title II of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 and how the outcome could have differed from the outcome under bankruptcy

We Must Resolve to End Too Big to Fail

By Sheila Bair (2011)

With the crises of the 1980s, the issues of moral hazard—resulting from the federal safety net and the resulting need for better market discipline—came to the fore. After the financial crisis of 2008, the emphasis has shifted to financial innovation and nonbank financial providers, followed by debate as to the causes of the recent crisis and the reforms needed to prevent such a disaster from recurring. There is concern that new regulations could impose onerous costs on banks and our economy, stifling financial innovation and economic growth. On the other hand, there is genuine alarm about the immense scale and seemingly indiscriminate nature of the government assistance provided to large banks and nonbank financial companies during the crisis, and what effects these actions will have on bank competition. Remarks by FDIC Chairman Sheila C. Bair on May 5, 2011, before the 47th Annual Conference on Bank Structure and Competition sponsored by the Federal Reserve Bank of Chicago.

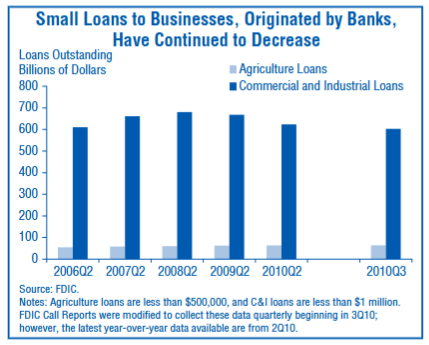

Microenterprise Development: A Primer

By Rae-Ann Miller, Heather Gratton, Luke W. Reynolds, Disha Shah and Kathy Zeidler (2011)

This article begins with a background on small businesses, small business lending, and the challenges small companies face in the current economic environment. It then focuses on the poverty alleviation aspect of entrepreneurship through microenterprise development—helping a segment of underserved small business owners create or expand their business. The article describes the scope of microenterprise development and the benefits to small business owners and their communities and includes case studies of organizations that participate in microenterprise development activities. It also describes the benefits to banks that participate in these activities.

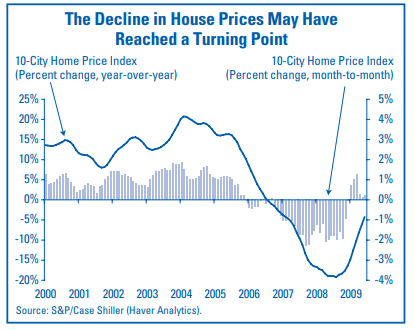

Measuring Progress in U.S. Housing and Mortgage Markets

By Cynthia Angell and Robert Miller (2010)

U.S. housing and mortgage markets have experienced historic distress over the past three years as evidenced by the significant decline in housing fundamentals. However, some signs of eventual recovery are beginning to emerge. This chartbook examines the housing and mortgage markets for tentative signs of recovery and evaluates those hopeful signs against the challenges that remain.