Banking Issues in Focus provides an in-depth analysis of topical banking issues. These articles range from timely analysis of economic and banking trends at the national and regional level that may affect the risk exposure of FDIC-insured institutions to research on issues affecting the banking system and the development of regulatory policy.

In the past, these articles were featured in FDIC Quarterly Volumes.

Recent Articles

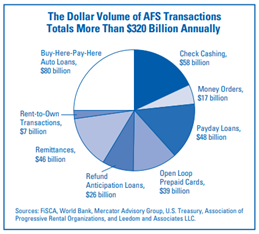

Alternative Financial Services: A Primer

By Christine Bradley, Susan Burhouse, Heather Gratton and Rae-Ann Miller (2009)

Alternative financial services (AFS) is a term often used to describe the array of financial services offered by companies that are not federally insured banks and thrifts. It sometimes also refers to financial services that are offered through alternative channels, such as the Internet or mobile phones. This article provides an overview of AFS and a description of the key products and services in this sector. It is intended as a primer for banks and others who are interested in understanding the competitive landscape in the financial services industry and exploring suitable opportunities in the AFS sector.

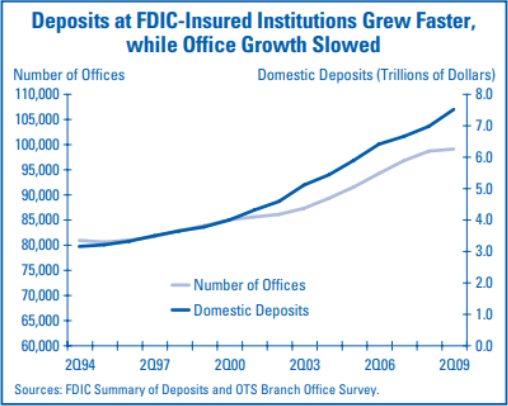

Highlights from the 2009 Summary of Deposits Data

By Robert Basinger (2009)

The FDIC and the Office of Thrift Supervision survey all FDIC-insured institutions to collect information on bank and thrift deposits and operating branches and offices each year as of June 30. The resulting Summary of Deposits (SOD) is a valuable resource for analyzing deposit trends and measuring market concentrations at the national and local levels. This article highlights findings from the 2009 SOF data, focusing on national trends in domestic deposits and banking offices but also present some information by state, metropolitan area, and institution.

Read article

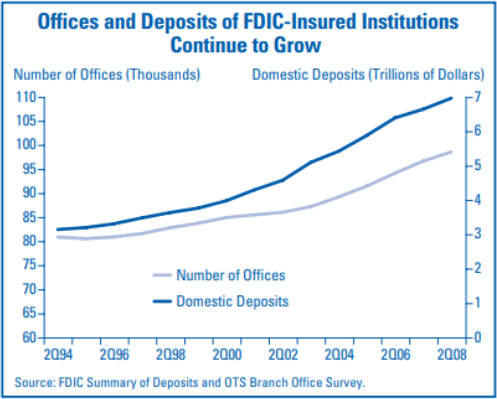

Highlights from the 2008 Summary of Deposits Data

By Robert Basinger (2008)

Each year, the Federal Deposit Insurance Corporation (FDIC) and the Office of Thrift Supervision (OTS) survey all FDIC-insured institutions to collect information on bank and thrift deposits, and operating branches and offices. The resulting FDIC Summary of Deposits (SOD) is a valuable resource for analyzing deposit market trends and measuring concentrations nationally and at the local level. This article highlights some preliminary conclusions from the 2008 SOD data. See page 30.

Read article

Increasing Deposit Insurance Coverage for Municipalities and Other Units of General Government: Results of the 2006 FDIC Study

By Christine Bradley and Valentine Craig (2008)

The Federal Deposit Insurance Reform Conforming Amendments Act of 2005 required the FDIC to study the feasibility of increasing the limit on deposit insurance coverage for municipalities and other units of general government. The study results were delivered to Congress in February 2007. This article examines the arguments for and against additional coverage for municipal deposits and considers whether private sector options provide a viable alternative to traditional public deposit collateralization programs.

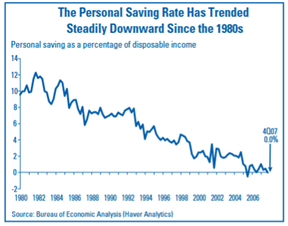

Building Assets, Building Relationships: Bank Strategies for Encouraging Lower-Income Households to Save

By Rae-Ann Miller, Susan Burhouse and Luke W. Reynolds (2008)

Saving enables individual households to meet unforeseen expenses and to plan for their financial futures. Not surprisingly, low- and moderate-income (LMI) households have the most difficulty saving. There is a common perception that banks do not view LMI households as potential profitable customers, but banks already have a relationship with a large number of these customers. This article explains the challenges LMI households face in building assets and examines the incentives banks have for encouraging these customers to save. The article also describes some strategies banks have used to build profitable relationships that also benefit lower-income consumers.