Banking Issues in Focus provides an in-depth analysis of topical banking issues. These articles range from timely analysis of economic and banking trends at the national and regional level that may affect the risk exposure of FDIC-insured institutions to research on issues affecting the banking system and the development of regulatory policy.

In the past, these articles were featured in FDIC Quarterly Volumes.

Recent Articles

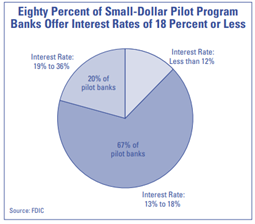

An Introduction to the FDIC’s Small-Dollar Loan Pilot Program

By Susan Burhouse, Rae-Ann Miller and Aileen Sampson (2008)

On February 5, 2008, the FDIC selected 31 banks to participate in its Small-Dollar Loan Pilot Program. The goal of the two-year pilot is to help the FDIC identify best practices in affordable small-dollar loan programs that can be replicated by other financial institutions. This article summarizes the key parameters of the pilot, the small-dollar loan program proposals that participating banks described in the applications, and the first quarter 2008 results. Banks in the pilot originated more than 3,100 small-dollar loans, with a principal balance of about $3.7 million in the first quarter.

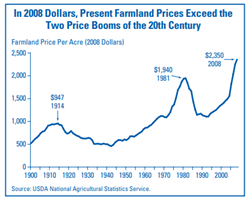

Do Record Farmland Prices Portend Another Steep Downturn for Agriculture and Farm Banks?

By Richard Cofer Jr., Jeffrey Walser and Troy Osborne (2008)

The agricultural crisis of the early 1980s remains a vivid memory for many in the farming community. The massive run-up in farmland prices in the late 1970s, followed by the sharp decline in land prices between 1981 and 1992, significantly contributed to the adverse effects on farmers and their lenders. Today, farmland values are rising at a pace reminiscent of the 1970s, raising concerns that another agricultural crisis may occur if land prices decline. This article briefly discusses some of the reasons for recent farmland price increases and analyzes their potential effect on FDIC-insured institutions.

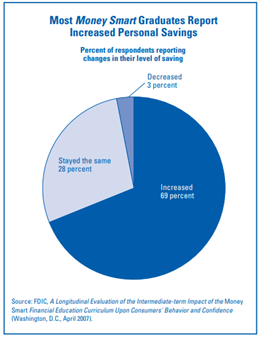

Banking on Financial Education

By Susan Burhouse, Angelisa Harris and Luke W. Reynolds (2007)

The rapidly expanding choices of financial products and services have increased the need for financial education. This article highlights the results of an FDIC study of its Money Smart financial education program. The study demonstrates the positive effects of this curriculum on consumer money management attitudes and behaviors. Importantly for bankers, the study shows that financial education can strengthen the relationships consumers have with banks and improve their financial condition and outlook. In addition, this article describes the many ways banks are offering financial education and offers suggestions for banks as they try to enhance their programs.

Privatizing Deposit Insurance: Results of the 2006 FDIC Study

By Christine Bradley and Valentine Craig (2007)

The Federal Deposit Insurance Reform Conforming Amendments Act of 2005 required the FDIC to conduct a study of the feasibility and consequences of privatizing deposit insurance. The results of the study were delivered to Congress in February of this year. This article reviews the arguments that favor privatization, examines specific privatization proposals, and concludes with a discussion of other considerations important to the privatization debate.

Establishing Voluntary Excess Deposit Insurance: Results of the 2006 FDIC Study

By Christine Bradley and Valentine Craig (2007)

The Federal Deposit Insurance Reform Conforming Amendments Act of 2005 required the FDIC to study the feasibility of establishing a voluntary deposit insurance system for deposits in excess of the maximum amount of FDIC insurance. The study results were delivered to Congress in early 2006. This article describes market changes that have reduced the demand for excess deposit insurance and provided depositors with other options to protect excess deposits. However, if Congress were to decide the FDIC should play a role in providing excess deposit insurance, the article examines two possible approaches available to the Corporation.