Banking Issues in Focus provides an in-depth analysis of topical banking issues. These articles range from timely analysis of economic and banking trends at the national and regional level that may affect the risk exposure of FDIC-insured institutions to research on issues affecting the banking system and the development of regulatory policy.

In the past, these articles were featured in FDIC Quarterly Volumes.

Recent Articles

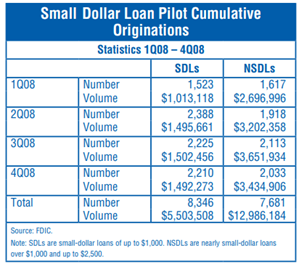

The FDIC’s Small-Dollar Loan Pilot Program: A Case Study After One Year

By Susan Burhouse, Rae-Ann Miller and Aileen Sampson (2009)

The FDIC’s Small-Dollar Loan Pilot Program is a two-year case study designed to identify best practices in affordable small-dollar loan programs that can be replicated by other financial institutions. This article summarizes results from the first four quarters of the pilot, highlights factors that have contributed to the success of participating banks’ programs, and presents the most common small-dollar loan business models.

Read article

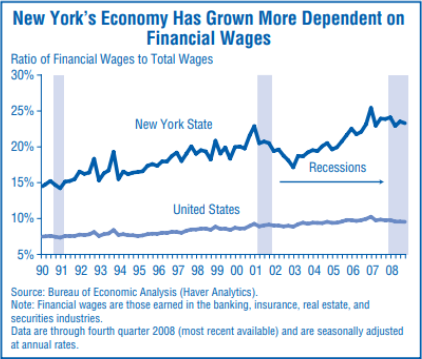

The 2009 Economic Landscape: Financial Sector Woes Pressure the Northeast

By Robert DiChiara and Kathy Kalser (2009)

Contraction in the nation’s financial sector is magnified in New York State and particularly New York City— the nation’s financial center. Statewide, the contribution of financial jobs to total wages has increased in recent years. At its peak in 2007, wages from financial jobs accounted for 25 percent of statewide wages, considerably more than their contribution at the national level.

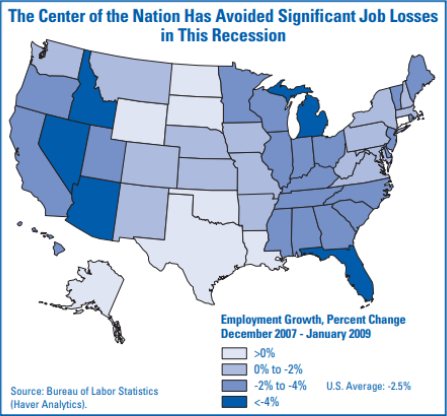

The 2009 Economic Landscape: How Long Can Energy and Agriculture Boost the Nation’s Midsection

By Adrian Sanchez and John M. Anderlik (2009)

The energy and agricultural sectors are important economic drivers for states in the center of the country. Extending from the oil patch of Texas, Louisiana, Arkansas, and Oklahoma, northward through the plains states and eastward to the Corn Belt, the states in the nation’s midsection are not only rich in land and other natural resources but also tend to rely heavily on these resources as drivers of economic activity. Booming commodity prices during the middle years of this decade have helped buoy the economies of these states, even while the rest of the country was moving toward recession. However, recent declines in many of these same commodity prices raise concerns about wider economic repercussions for these regions as the U.S. recession continues. This article describes how commodity industries drive the economies of the nation’s midsection and evaluates their outlook after the commodity price boom.

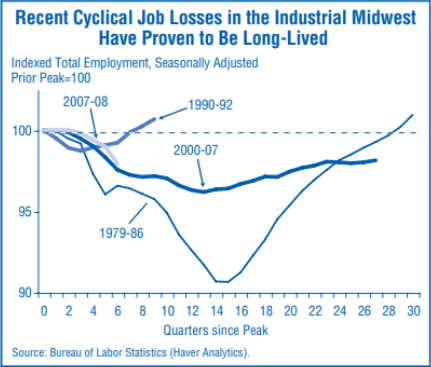

The 2009 Economic Landscape: Recession adds to Long-Term Manufacturing Challenges in the Industrial Midwest

By Patrick Dervin and John M. Anderlik (2009)

The manufacturing sector has long been a primary economic driver of the Industrial Midwest. This region, which comprises eight states in the north-central United States, is known for its durable goods manufacturing, a sector that includes the production of automobiles and other types of heavy machinery. The emphasis on manufacturing has posed challenges for the region as the sector has contracted. This article discusses manufacturing trends in the Industrial Midwest, particularly with respect to the troubled auto sector, and the economic outlook for the region.

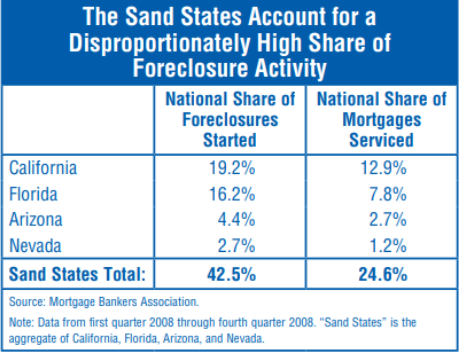

The 2009 Economic Landscape: The Sand States: Anatomy of a Perfect Housing-Market Storm

By Shayna Olesuk and Kathy Kalser (2009)

The historic boom and subsequent decline in the nation’s housing market has been a defining feature of the current recession. The housing downturn has been most acute in four states—Arizona, California, Florida, and Nevada— that had experienced some of the highest rates of home price appreciation in the first half of the decade. While these states are not all contiguously located, their similar housing cycles and abundance of either beaches or deserts have led some analysts to label them “Sand States.” This article discusses the factors that led to an expanding housing sector in these states and the market imbalances that culminated in a sharp correction in home prices. The article also explores the ripple effects that the housing downturn has had on the local economies.