Banking Issues in Focus provides an in-depth analysis of topical banking issues. These articles range from timely analysis of economic and banking trends at the national and regional level that may affect the risk exposure of FDIC-insured institutions to research on issues affecting the banking system and the development of regulatory policy.

In the past, these articles were featured in FDIC Quarterly Volumes.

Recent Articles

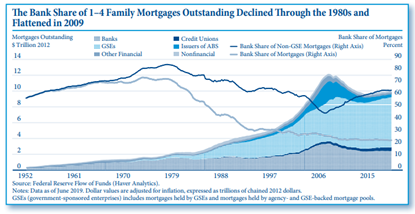

Trends in Mortgage Origination and Servicing: Nonbanks in the Post-Crisis Period

By Kayla Shoemaker (2019)

The mortgage market changed notably after the collapse of the U.S. housing market in 2007 and the financial crisis that followed. A substantive share of mortgage origination and servicing, and some of the risk associated with these activities, migrated outside of the banking system. Some risk remains with banks or could be transmitted to banks through other channels, including bank lending to nonbank mortgage lenders and servicers. Changing mortgage market dynamics and new risks and uncertainties warrant investigation of potential implications for systemic risk.

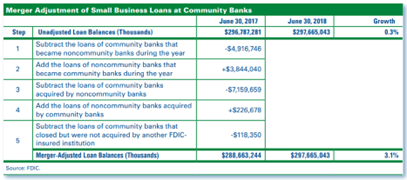

Merger Adjusting Bank Data: A Primer

By Eric Breitenstein and Derek Thieme (2018)

Analysis of banking trends often focuses on specific industry subgroups. The analyst tracks the performance or characteristics of an industry subgroup over time, and the results, if compelling, can serve as input to policy decisions. An important component of analyzing industry subgroups is a procedure called merger adjustment. This article describes how and when FDIC analysts use merger adjustment when analyzing the banking industry. It discusses when to merger adjust and when not to merger adjust and offers guidance for interpreting the results.

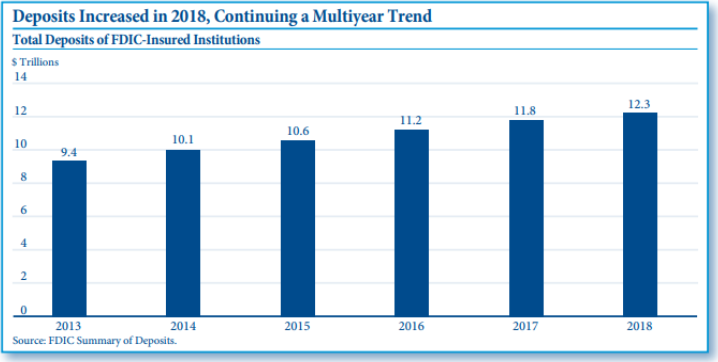

2018 Summary of Deposits Highlights: Deposit Growth Slows and Office Decline Continues

By Joseph Harris III, Derek Thieme and Angela Woodhead (2018)

The 2018 Summary of Deposits Survey showed that FDIC-insured institutions reported an increase in deposits and a decrease in offices over the past year. During the year ended June 2018, deposits increased at both noncommunity banks and at community banks, but at slower rates than in recent years. The decrease in the number of offices is a decade-long trend in both community banks and noncommunity banks, although the office opening and closing patterns of these two types of institutions has differed markedly. This article will describe these trends in detail and will look at the association between office closures and changes in bank profitability and efficiency. Analysis of Call Report data indicates that banks that closed offices at higher rates between 2013 and 2018 reported improved efficiency ratios and stronger profitability.

Read article

Factors Shaping Recent Trends in Banking Office Structure for Community and Noncommunity Banks

By Nathan Hinton, Derek Thieme and Angela Woodhead (2017)

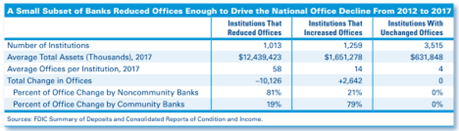

Total industry deposits grew once again in 2017, and the rate of deposit growth was higher at community banks than at noncommunity banks, according to the 2017 Summary of Deposits (SOD) survey. Key findings from the SOD survey also show that the number of offices operated by noncommunity banks declined on a merger-adjusted basis in the most recent year and over the past five years, while the number of community bank offices increased slightly over both intervals. Relatively few banks have reported a net decline in their number of offices over the past five years, yet cutbacks in offices at these banks have been large enough to drive a sizable decline in the overall number of banking industry offices since 2012. This continuing trend of fewer banking offices can be attributed to factors such as population migration, office expense mitigation, industry consolidation, and financial technology.

Read article

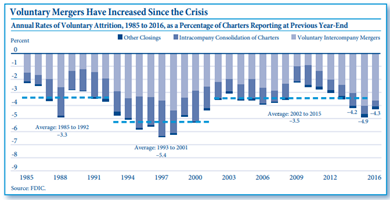

Community Bank Mergers Since the Financial Crisis: How Acquired Community Banks Compared with Their Peers

By Nathan Hinton and Eric Breitenstein (2017)

An increase in mergers and a dearth of new charters in the post-crisis period have renewed the interest of researchers in banking industry consolidation. This analysis focuses on community banks acquired between 2010 and 2016 in voluntary, inter-bank transactions and compares their characteristics with selected peer institutions. It refines the peer-group selection used in previous research by applying the FDIC’s community bank definition and controlling for asset size, geography, and lending specialty—a method that can be applied to future peer group analyses. A comparison of acquired community banks with their peers shows that acquired institutions were typically less profitable, reported lower capital ratios, and reported higher core deposit-to-asset ratios but lower ratios of nonperforming assets. The results of this research are consistent with past findings that acquired community banks generally underperform their peers.