Banking Issues in Focus provides an in-depth analysis of topical banking issues. These articles range from timely analysis of economic and banking trends at the national and regional level that may affect the risk exposure of FDIC-insured institutions to research on issues affecting the banking system and the development of regulatory policy.

In the past, these articles were featured in FDIC Quarterly Volumes.

Recent Articles

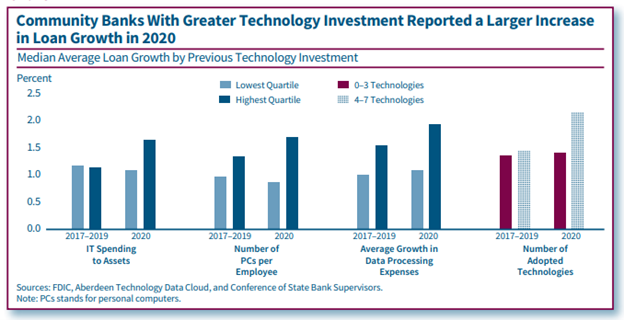

The Importance of Technology Investments for Community Bank Lending and Deposit Taking During the Pandemic

By Daniel Hoople (2021)

Community banks that invested more in technology generally reported faster loan and deposit growth in 2020 than did banks with less technology investment. Moreover, the differences in loan and deposit growth associated with technology investment were greater in 2020 than the differences reported prior to the pandemic. Faster loan growth for community banks with greater technology investment largely stemmed from participation in the Paycheck Protection Program (PPP). These community banks, on average, originated a greater share of PPP loans regardless of the loan size, origination date, or borrower distance from the nearest bank branch. Meanwhile, the larger increases in deposit growth of community banks that invested more in technology were due to increases in deposit balances of existing customers rather than from new depositors.

2019 Summary of Deposits Highlights

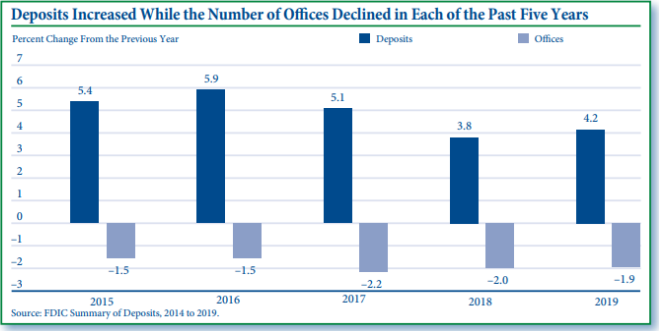

By Joseph Harris III, Caitlyn Kasper, Christopher Raslavich and Derek Thieme (2020)

The 2019 Summary of Deposits Survey showed an increase in deposits and a decrease in the number of branch offices, continuing recent trends. The reduction in the number of bank offices occurred nationwide, but the number of counties with a banking office has remained relatively stable over the past five years. The rate of decline was faster among offices in metropolitan counties, limited-service offices, and offices with lower reported levels of deposits. This article examines characteristics of the offices of operating banks that close versus those that are sold or leased, and of offices that close versus those that remain open after bank acquisitions. The rate of deposit growth increased for both community and noncommunity banks, but the merger-adjusted or “organic” rate of deposit growth at community banks exceeded that of noncommunity banks for the third consecutive year. For selected topics, comparative information about credit unions is included.

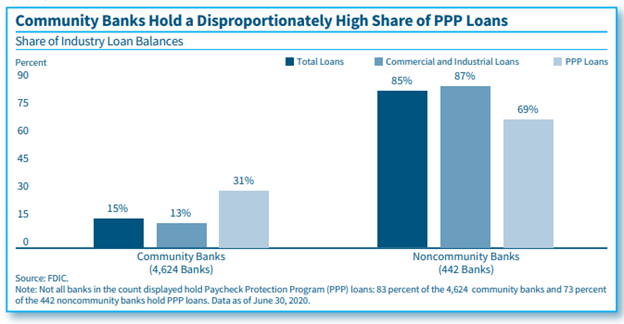

The Importance of Community Banks in Paycheck Protection Program Lending

By Margaret Hanrahan and Angela Hinton (2020)

During the current public health emergency, community banks are playing a vital role in supporting small businesses through the Small Business Administration’s Paycheck Protection Program (PPP). Community banks throughout the country participated in the program, with community bank PPP loan portfolios representing over 30 percent of total bank PPP loans.

Bank and Nonbank Lending Over the Past 70 Years

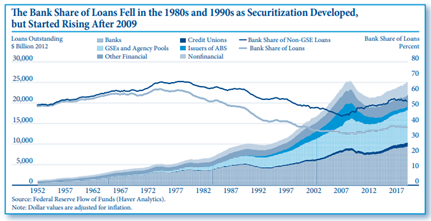

By Kathryn Fritzdixon (2019)

Total lending in the U.S. has grown dramatically in the past 70 years and since the 1970s, the share of bank loans has generally fallen as nonbanks gained market share in residential mortgage and corporate lending. In other business lines, shifts in loan holdings from banks to nonbanks have been less pronounced as banks and nonbanks continue to play important roles in lending for commercial real estate, agricultural loans, and consumer credit. Studying the roles that banks and nonbanks play in lending markets allows for a better understanding of how banks respond to growth in nonbank lending and the implications of associated risks for the banking sector and the broader economy.

Read article

Leveraged Lending and Corporate Borrowing: Increased Reliance on Capital Markets, With Important Bank Links

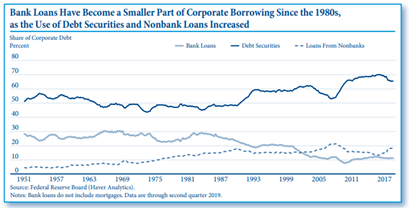

By Frank Martin-Buck (2019)

Over the past decade, U.S. nonfinancial corporate debt reached record highs as issuance of corporate bonds and leveraged loans grew rapidly while credit quality and lender protections deteriorated. Much of this growth in corporate borrowing came through capital markets, though important connections to the banking system remain. This article examines this shift in corporate borrowing to capital markets over the past several decades. It also details the ways corporate debt has grown, the resulting risks this shift poses to banks since the 2008 financial crisis, and what factors could mitigate those risks.

Read article