Banking Issues in Focus provides an in-depth analysis of topical banking issues. These articles range from timely analysis of economic and banking trends at the national and regional level that may affect the risk exposure of FDIC-insured institutions to research on issues affecting the banking system and the development of regulatory policy.

In the past, these articles were featured in FDIC Quarterly Volumes.

Recent Articles

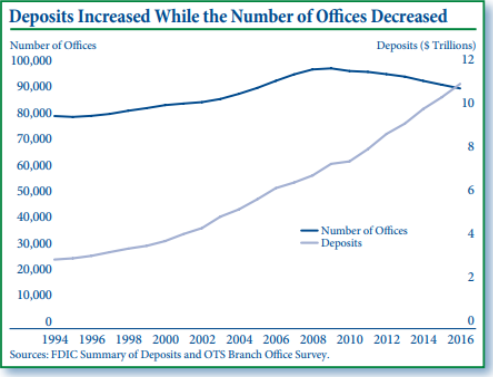

Banks Attract More Deposits While Operating Fewer Offices

By Nathan Hinton, Derek Thieme and Angela Woodhead (2017)

Deposits across the banking industry grew while the number of offices shrank among noncommunity banks and increased among community banks from the previous year, according to the 2016 Summary of Deposits survey. Meanwhile, offices in energy-dependent counties reported almost no deposit growth as natural gas, oil, and coal prices fell.

Read article

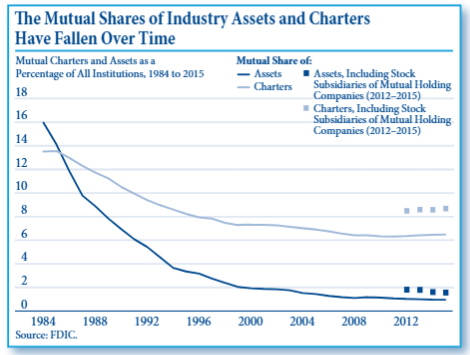

Mutual Institutions: Owned by the Communities They Serve

By Eric Breitenstein and Clayton Boyce (2016)

Mutual institutions—savings banks and savings and loans owned by their depositors—are a unique type of community bank. This paper provides an overview of mutual institutions and their place in the U.S. financial system. They generally earn lower returns on assets than stock community banks, but have higher-quality assets. Mutuals also failed less often between 2008 and 2014 than did stock community banks. From their 19th-century origins as providers of small-denomination savings accounts and the means of pooling funds to finance homeownership, to their dominance of U.S. mortgage finance for much of the 20th century, and to their strong performance during the recent financial crisis, mutuals remain an important segment of the community banking sector.

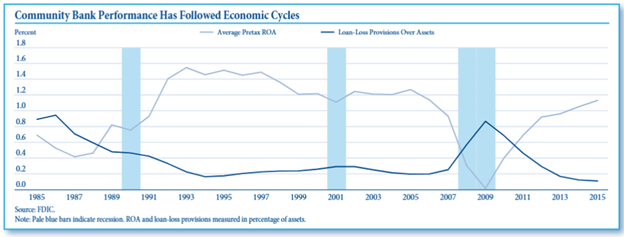

Core Profitability of Community Banks: 1985 – 2015

By Jared Fronk (2016)

The relatively low profitability reported by community banks since the 2008 financial crisis has sparked concerns about the core profitability of the community banking model. This paper constructs an econometric model using 31 years of data to estimate the impact of macroeconomic shocks on industry average pretax return on assets (ROA). After accounting for macroeconomic factors, the remaining unexplained variation is considered to be the core component of profitability. Core ROA is found to have been relatively stable between 1985 and 2015. It trended downward over the 1990s, but the effect of the financial crisis on industry composition has led to a reversal and a modest increase in core profitability. More than 80 percent of the post-crisis decline in profitability can be explained by negative macroeconomic shocks.

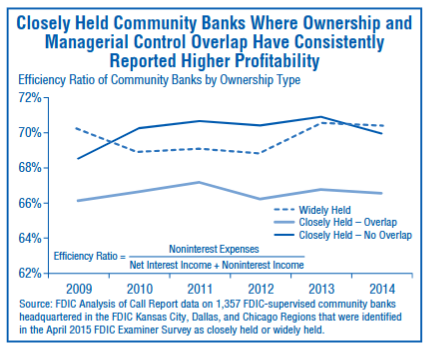

Financial Performance and Management Structure of Small, Closely Held Banks

By John Anderlik, Richard Brown and Kathryn Fritzdixon (2015)

Closely held banks may face operational challenges in raising external capital and recruiting future managers, especially in rural areas. At the same time, closely held banks may have certain operational advantages, including the ability to focus on long-term goals and to minimize principal-agent problems that may arise from the separation of ownership and operational control. This paper compares the performance of closely and widely held banks as identified in a survey of FDIC bank examiners and finds that closely held banks do not appear, on net, to be underperforming widely held banks in recent years. Closely held banks where the day-to-day manager is a member of the ownership group seem to outperform banks with a hired manager. The survey of bank examiners in three FDIC supervisory Regions was used to identify the ownership and management structure of more than 1,350 community banks. The survey results suggest that almost 75 percent of community banks in these Regions can be regarded as closely held, typically on the basis of family or community ties.

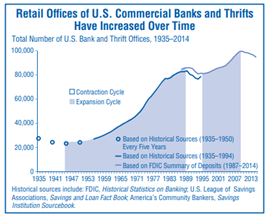

Brick-and-Mortar Banking Remains Prevalent in an Increasingly Virtual World

By Eric Breitenstein and John McGee (2014)

This paper chronicles long-term trends in the number and density of U.S. banking offices from 1935 to 2014. The study examines the effects that population trends, bank crises, changes in banking laws, and online and mobile banking have had on the number and density of banking offices, and explores the relationship between technology and brick-and-mortar bank offices.

Read article