Banking Issues in Focus provides an in-depth analysis of topical banking issues. These articles range from timely analysis of economic and banking trends at the national and regional level that may affect the risk exposure of FDIC-insured institutions to research on issues affecting the banking system and the development of regulatory policy.

In the past, these articles were featured in FDIC Quarterly Volumes.

Recent Articles

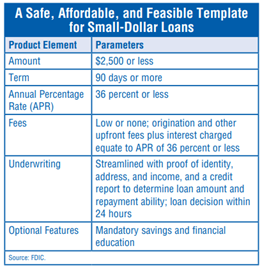

A Template for Success: The FDIC’s Small-Dollar Loan Pilot Program

By Rae-Ann Miller, Susan Burhouse, Luke W. Reynolds and Aileen Sampson (2010)

The Federal Deposit Insurance Corporation’s (FDIC) two-year Small-Dollar Loan Pilot Program concluded in the fourth quarter of 2009. The pilot was a case study designed to illustrate how banks can profitably offer affordable small-dollar loans as an alternative to high-cost credit products such as payday loans and fee-based overdraft programs. This article summarizes the results of the pilot, outlines the lessons learned and the potential strategies for expanding the supply of affordable small-dollar loans, and highlights pilot bank successes through case studies.

Read article

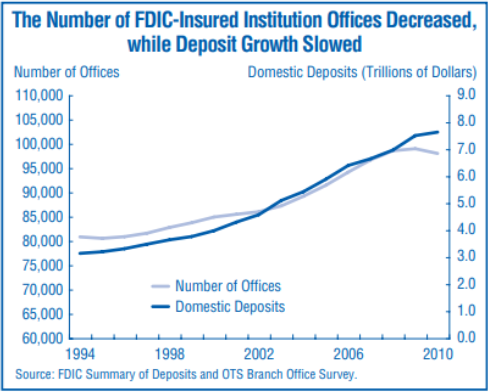

Highlights from the 2010 Summary of Deposits

By Robert Basinger (2010)

Each year as of June 30, the FDIC and the Office of Thrift Supervision survey each FDIC-insured institution to collect information on bank and thrift deposits and operating branches and offices. The resulting Summary of Deposits (SOD) is a valuable resource for analyzing deposit and office trends as well as domestic deposit market share. This article highlights findings from the 2010 SOD.

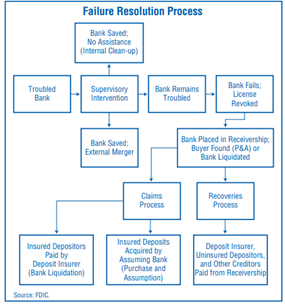

A Guide to Processing Deposit Insurance Claims: A Cross-Country Perspective

By Christine Blair and Rose Kushmeider (2010)

This article discusses the deposit insurance claims process, whereby insured depositors are reimbursed when a bank fails. The article reviews the role of deposit insurers in a bank failure as well as their responsibilities in the claims process. It also reviews the basic tools that deposit insurers need to satisfy the claims of insured depositors (and others) and the procedures commonly followed in the claims process. Finally, the article explores the claims process of deposit insurers in Canada, the Philippines, the Russian Federation, and the United States.

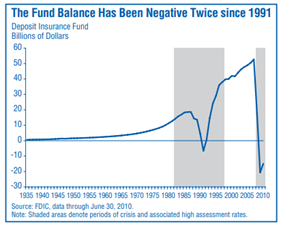

Toward a Long-Term Strategy for Deposit Insurance Fund Management

By Lee Davison and Ashley Carreon (2010)

The FDIC has developed a comprehensive, long-range management plan for the Deposit Insurance Fund. The plan is designed to reduce pro-cyclicality; keep assessment rates moderate, steady, and predictable throughout economic and credit cycles; and maintain a positive fund balance even during a period of large fund losses. This article presents the FDIC analysis that informed the medium- and long-term elements of the plan. Using multiple simulations, this analysis demonstrates that a moderate, long-term average industry assessment rate, combined with an appropriate dividend or assessment rate reduction policy, would have prevented the fund from becoming negative during both the crises of the 1980s and early 1990s and the current crisis. However, the fund’s reserve ratio would have had to have exceeded 2 percent before the crises began.

The 2009 Economic Landscape: How the Recession Is Unfolding Across Four U.S. Regions

By Richard Brown (2009)

The following series of articles takes a closer look at the distinct way that this recession is playing out in four major regions of the country. The first article describes how the latest downturn is exacerbating long-term problems in the manufacturing sector of the Industrial Midwest. In the second article, we explore how formerly booming housing markets in Arizona, California, Florida, and Nevada have given way to a housing bust that has sharply reversed the momentum of the regional economy. The third article focuses on the impact of financial market turmoil on New York City and other financial centers along the East Coast, while the fourth article outlines why a number of states in the nation’s midsection have fared better than most thus far because of their high dependence on energy and agricultural production.