Banking Issues in Focus provides an in-depth analysis of topical banking issues. These articles range from timely analysis of economic and banking trends at the national and regional level that may affect the risk exposure of FDIC-insured institutions to research on issues affecting the banking system and the development of regulatory policy.

In the past, these articles were featured in FDIC Quarterly Volumes.

Recent Articles

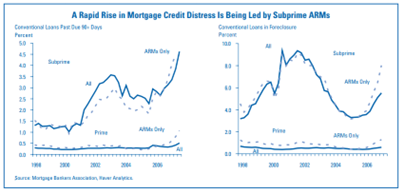

The Case for Loan Modification

By Sheila Bair (2007)

The combination of weakening in mortgage credit quality, upward pricing of hybrid adjustable-rate mortgages, falling home prices, and fewer refinancing options highlights the need to find a workable solution to current problems in the U.S. subprime mortgage market. This article describes a systematic and streamlined approach to loan modification that will help avert foreclosure for certain subprime borrowers who cannot afford to continue making mortgage payments when interest rates reset. The article also addresses common misconceptions about this approach. The text of this article is based on testimony delivered by Sheila C. Bair, Chairman, Federal Deposit Insurance Corporation, on December 6, 2007, before the U.S. House of Representatives Financial Services Committee.

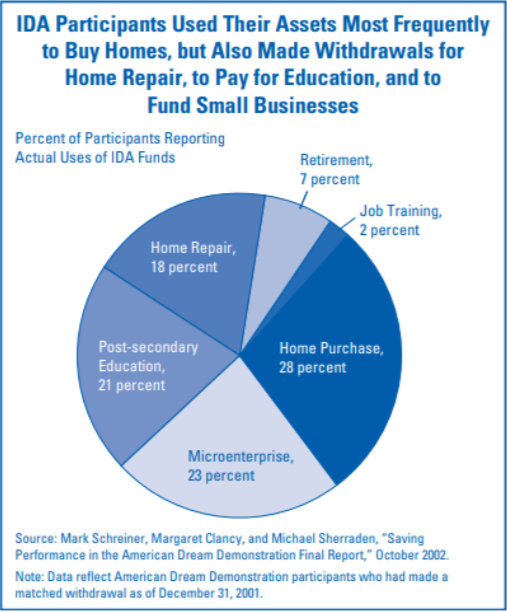

Individual Development Accounts and Banks: A Solid ‘Match’

By Rae-Ann Miller and Susan Burhouse (2007)

Even with the greater access to banking products and services provided through the development of alternative delivery channels, including the Internet, about 10 million American households, typically low- and moderate-income families, do not use the banking system. Many more only use a limited number of banking services. A particular type of savings account, the Individual Development Account (IDA), is a relatively low risk way for banks to introduce these households to the banking system. This article explains how IDAs operate, describes banks’ experience with IDAs, and points bankers to sources of information about these programs.

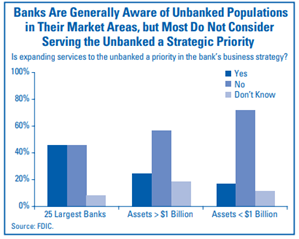

Findings From the FDIC Survey of Bank Efforts to Serve the Unbanked and Underbanked

By Barbara Ryan and Susan Burhouse

This article summarizes key findings of the FDIC Survey of Bank Efforts to Serve the Unbanked and Underbanked. It is intended to inform bankers, policymakers, and researchers of the results of the survey and to outline steps for improving access to the mainstream financial system.