Banking Issues in Focus provides an in-depth analysis of topical banking issues. These articles range from timely analysis of economic and banking trends at the national and regional level that may affect the risk exposure of FDIC-insured institutions to research on issues affecting the banking system and the development of regulatory policy.

In the past, these articles were featured in FDIC Quarterly Volumes.

Recent Articles

Minority Depository Institutions: Structure, Performance, and Social Impact

By Eric Breitenstein, Karyen Chu, Kathy Kalser and Eric Robbins (2014)

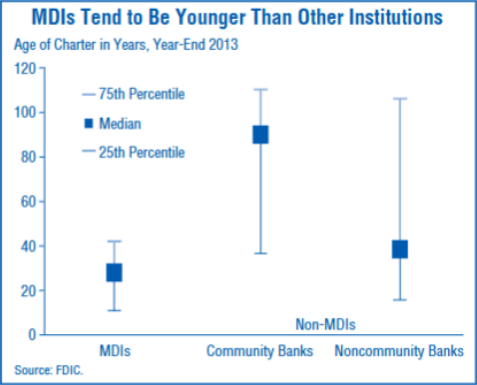

While the number of minority depository institutions (MDIs) and community development financial institutions (CDFIs) is relatively small compared with the total number of insured institutions, MDIs and CDFIs play an important role in providing financial services to the communities they seek to serve. This study describes MDIs and FDIC-insured CDFIs and how the structure of this segment of the financial services industry has changed over time. The study also compares the performance of MDIs with other insured institutions.

Although MDIs tend to underperform non-MDI institutions in terms of standard industry financial performance measures, the study finds that MDI offices tend to be located in communities with higher shares of minority populations. In addition, MDIs were found to originate a greater share of their mortgages to borrowers living in low- and moderate-income census tracts and to minority borrowers compared with other financial institutions. These findings demonstrate a high level of commitment on the part of MDIs to the populations they seek to serve and the essential role they play in their local communities.

Long-Term Trends in Rural Depopulation and Their Implications for Community Banks

By John M. Anderlik and Richard Cofer Jr. (2014)

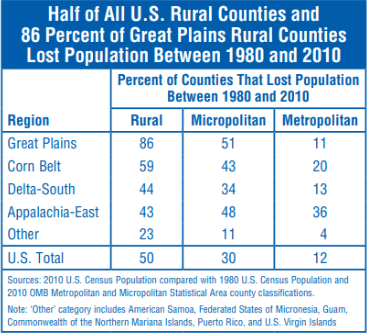

This article discusses rural depopulation, a long-term trend that not only encompasses half of the nation’s rural counties, but also intensified in many areas in the 2000s. Technological advances that continue to make farms larger are the main driver of the trends, and as such the Great Plains and the Corn Belt are the areas with the most counties experiencing population outflows. Community banks in depopulating areas tend to specialize in agricultural lending, which is far less common in metropolitan and micropolitan areas. The unusual strength in the agricultural sector in the 2000s, even through the U.S. recession, helped community banks in depopulating rural areas avoid many of the asset quality and earnings issues that affected banks located elsewhere. The strong agricultural sector also enabled these institutions to grow assets and deposits at relatively high rates, when such growth had been challenging in these areas before the agricultural boom.

Community Banks Remain Resilient Amid Industry Consolidation

By Benjamin Backup and Richard Brown (2014)

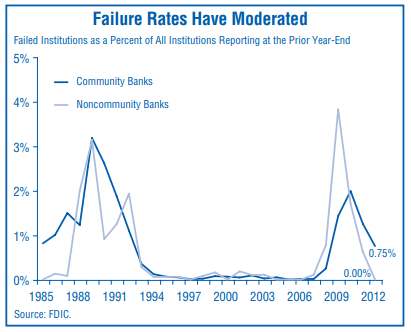

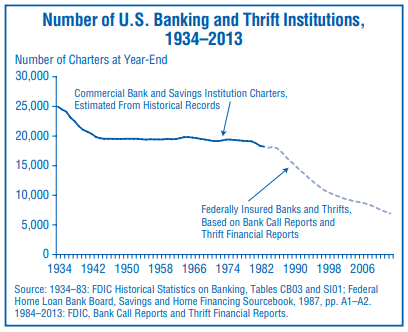

There has been a great deal of focus recently on banking industry consolidation and its effects on community banks. New analysis based on the FDIC’s functional definition of the community bank shows that these institutions have been highly resilient amid long-term industry consolidation. The rate of attrition among community banks over the past decade has been less than half that of noncommunity banks. When community banks have been acquired, almost two-thirds of the time the acquirer has been another community bank. After more than 30 years of consolidation, the evidence strongly suggests that community banks will continue to carry out their important financial role for the foreseeable future.

Highlights from the 2012 Summary of Deposit

By Andrew Carayiannis (2013)

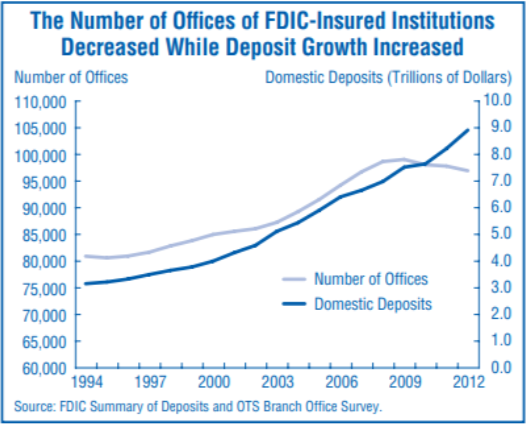

Each year as of June 30, the FDIC surveys each FDIC-insured institution to collect information on bank and thrift deposits and operating branches and offices. The resulting Summary of Deposits (SOD) is a valuable resource for analyzing deposit and office trends as well as domestic deposit market share. This article highlights findings from the 2012 SOD. See page 27.

Community Bank Developments in 2012

By Benjamin Backup (2013)

This paper updates the 2012 FDIC Community Banking Study to reflect developments in the structure and performance of U.S. community banks through the end of 2012. It finds that while the community banking sector changed little in structural terms during the year, community banks showed continued improvement in financial performance following the disruptions associated with the recent financial crisis. Problem loans and failures declined among community banks in 2012, while their pretax profitability was the highest since 2007. While community banks hold just 14 percent of industry assets, they make up almost 95 percent of all U.S. banking organizations. The sector continues to hold nearly half of the industry’s small loans to farms and businesses, as well as the majority of deposits in U.S. rural and micropolitan counties.