FDIC-Insured Institutions Reported Return on Assets of 1.13 Percent and Net Income of $69.9 Billion in Second Quarter 2025

- Net Income Decreased from the Prior Quarter, Driven by an Increase in Provision Expenses Related to a Large Bank Acquisition

- Community Bank Net Income Increased from the Prior Quarter

- The Deposit Insurance Fund Reserve Ratio Increased Five Basis Points to 1.36 Percent; Now Exceeds Statutory Minimum

- Quarterly Net Interest Margin Remained Relatively Unchanged from the Prior Quarter

- Asset Quality Metrics Remained Generally Favorable, Though Weakness in Certain Portfolios Persisted

- Loan Growth Accelerated from the Prior Quarter

- Domestic Deposits Increased for the Fourth Consecutive Quarter

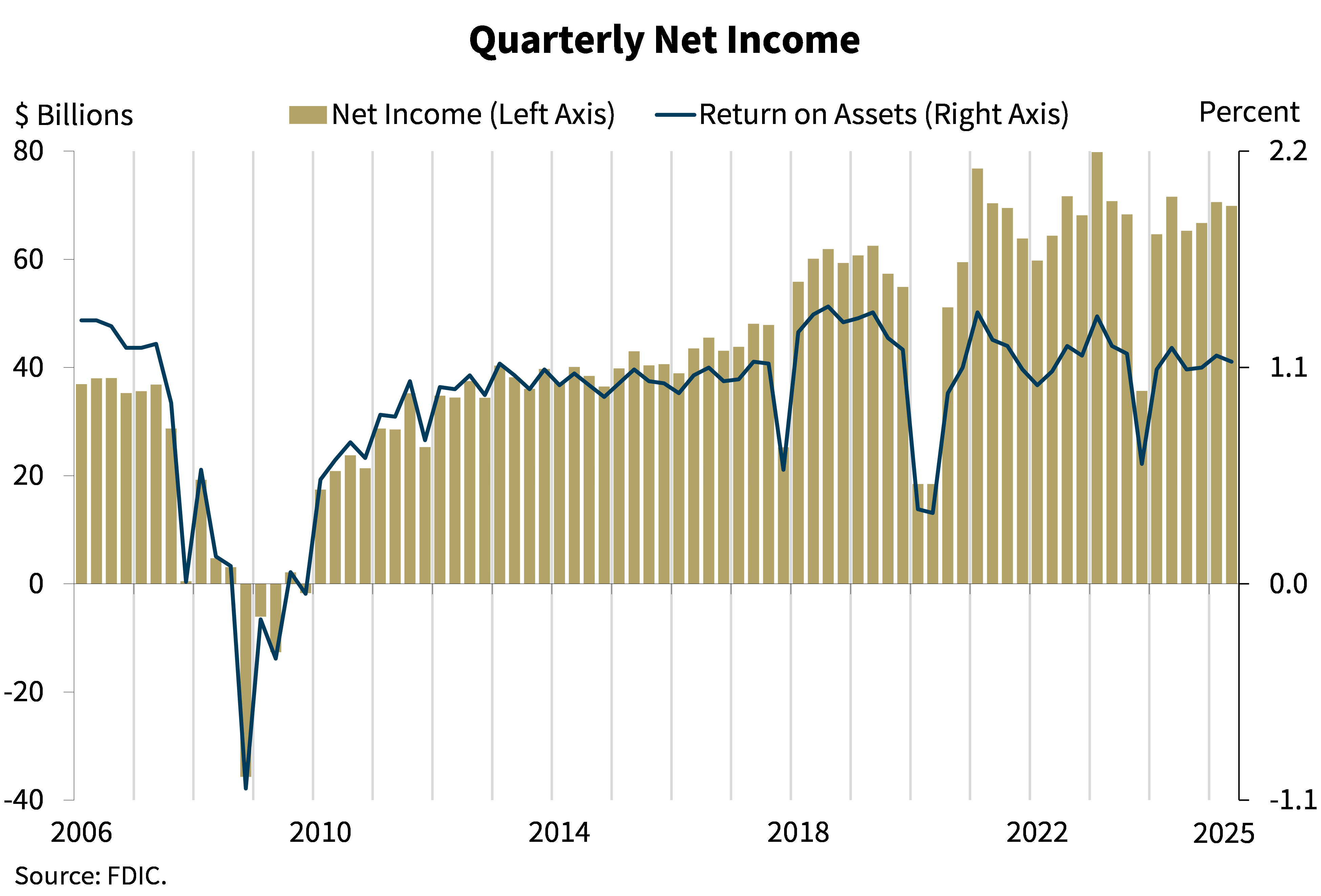

WASHINGTON—The Federal Deposit Insurance Corporation (FDIC) today released the results of its latest Quarterly Banking Profile, a comprehensive summary of financial results based on reports from 4,421 insured commercial banks and savings institutions. In second quarter 2025, insured depository institutions reported a return on assets (ROA) ratio of 1.13 percent and aggregate net income of $69.9 billion, a decrease of $677.3 million (1 percent) from the prior quarter. Net income for the industry would have increased absent an increase in provision expenses related to a large bank acquisition.

Highlights from the Second Quarter 2025 Quarterly Banking Profile

Net Income Decreased from the Prior Quarter, Led by Higher Provision Expenses: For the 4,421 FDIC-insured commercial banks and savings institutions aggregate quarterly net income totaled $69.9 billion, down $677.3 million (1 percent) from the prior quarter. The banking industry reported an aggregate ROA of 1.13 percent in second quarter 2025, down from 1.16 percent in first quarter 2025 and 1.20 percent in the year-ago quarter. The quarterly decrease in net income was driven by higher provision expenses (up $7.6 billion, or 33.7 percent). The increase in provision expense was largely attributable to the acquisition of one large bank, as accounting standards require the acquiring institution to recognize a provision expense related to certain acquired assets. Absent this large provision expense, net income would have increased due to higher net interest and noninterest income.

Community Bank Net Income Increased from the Prior Quarter: Quarterly net income for the 3,982 community banks insured by the FDIC totaled $7.6 billion in the second quarter, an increase of $842.9 million (12.5 percent) from first quarter 2025. The community bank pretax ROA increased 15 basis points from the prior quarter to 1.33 percent. Higher net interest income (up $1.2 billion, 5.7 percent) and noninterest income (up $483.3 million, 10.1 percent) more than offset increases in noninterest expense (up $612.7 million, 3.5 percent) and provision expense (up $311.5 million, 29.2 percent).

The Deposit Insurance Fund Reserve Ratio Increased Five Basis Points to 1.36 Percent: In the second quarter, the Deposit Insurance Fund balance increased $4.4 billion to $145.3 billion. The reserve ratio increased 5 basis points during the quarter to 1.36 percent. As of June 30, 2025, the reserve ratio exceeded the statutory minimum and, beginning with third quarter 2025, the FDIC will no longer be operating under the Restoration Plan.

Quarterly Net Interest Margin Remained Relatively Unchanged from the Prior Quarter: The industry reported a quarterly increase in net interest income (up $2.9 billion, or 1.6 percent) as interest income increased more than interest expense. The net interest margin (NIM) was relatively flat, up by one basis point to 3.26 percent, which is above the pre-pandemic average of 3.25 percent.1 The community bank NIM of 3.62 percent increased 16 basis points from the prior quarter, increasing for the fifth consecutive quarter and approaching the pre-pandemic average of 3.63 percent.

Asset Quality Metrics Remained Generally Favorable, Though Weakness in Certain Portfolios Persisted: Past-due and nonaccrual (PDNA) loans, or loans that are 30 or more days past due or in nonaccrual status, fell 9 basis points from the prior quarter to 1.50 percent of total loans. The industry’s PDNA ratio is still below the pre-pandemic average of 1.94 percent. While banks reported quarterly decreases in PDNA of credit card loans (down $1.9 billion, or 24 basis points to 2.98 percent), and 1–4 family residential loans (down $1.5 billion, or 7 basis points to 1.86 percent), the PDNA rate for non-owner-occupied commercial real estate (CRE), multifamily CRE, and credit card portfolios remain well above their pre-pandemic averages.

The industry’s net charge-off ratio of 0.60 percent decreased 6 basis points from the prior quarter and is 8 basis points lower than the year-ago quarter. This ratio is 12 basis points above the pre-pandemic average. Most portfolios have net charge-off rates above their pre-pandemic averages.

Loan Growth Accelerated from the Prior Quarter: Total loan and lease balances increased $263.7 billion (2.1 percent) from the prior quarter. Loans to non-depository financial institutions (NDFIs) and loans to purchase or carry securities, including margin loans, had the largest dollar increase among loan types reported, though some of this increase was due to continued reclassifications following the finalization of changes to how certain loan products are reported. In addition, credit cards, adjustable-rate 1–4 family residential loans, and nonfarm nonresidential CRE contributed to the industry’s quarterly loan growth. The industry’s annual rate of loan growth in the second quarter was 4 percent, below the pre-pandemic average of 4.9 percent.

Total loans at community banks increased 1.7 percent from the prior quarter and 4.9 percent from the prior year, led by increases in nonfarm nonresidential CRE loans and 1–4 family residential mortgage portfolios.

Domestic Deposits Increased for the Fourth Consecutive Quarter: Domestic deposits increased $101.5 billion (0.6 percent) from first quarter 2025, rising for a fourth consecutive quarter. Estimated uninsured domestic deposits increased $186.4 billion (2.4 percent), offsetting a $87.3 billion (0.8 percent) decline in insured domestic deposits.

The Total Number of Insured Institutions Declined: The total number of FDIC-insured institutions declined by 41 during the second quarter to 4,421. During the quarter, two banks opened, one bank failed, five banks were sold to non-FDIC-insured institutions, and 37 institutions merged with other banks.

| 1 | The “pre-pandemic average” is the average from first quarter 2015 through fourth quarter 2019. |