Banking Issues in Focus provides an in-depth analysis of topical banking issues. These articles range from timely analysis of economic and banking trends at the national and regional level that may affect the risk exposure of FDIC-insured institutions to research on issues affecting the banking system and the development of regulatory policy.

In the past, these articles were featured in FDIC Quarterly Volumes.

Recent Articles

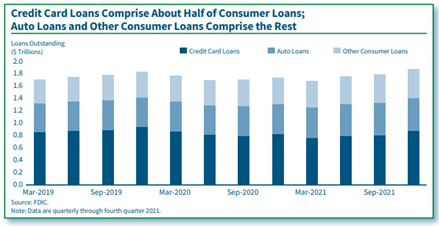

Consumer Lending Through the Pandemic and the Recovery

By Kathryn Fritzdixon (2022)

The COVID-19 pandemic pushed the economy into what was, by some measures, the worst contraction on record, but consumer lending trends did not deteriorate as they usually do during a recession. Government support for households raised aggregate personal income in 2020 and helped support consumer loan performance. While credit card loan balances contracted in 2020 and remained below the pre-recession level through third quarter 2021, auto loans and other consumer loans expanded throughout 2020 and 2021. Performance of all types of bank consumer loans improved thanks to government support, forbearance programs, and tighter underwriting standards for new loans. While caution is warranted, and changes in the pandemic and responses could weaken the outlook, the future of consumer lending appears strong.

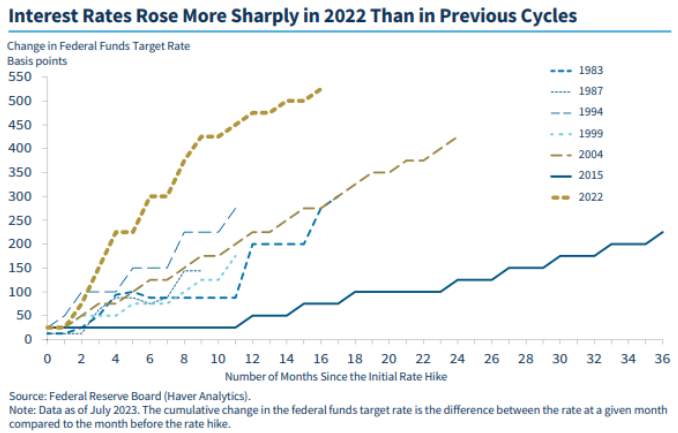

Banking Sector Performance During Two Periods of Sharply Higher Interest Rates: 2022 and 2004 to 2006

By Nafij Ahmed, Dorothy Miranda and Krishna Patel (2022)

Interest rates rose dramatically in 2022, causing an abrupt shift in banking conditions. The increase in the federal funds target rate in 2022 was the largest and fastest since the 1980s and followed an extended period of low interest rates. Intermediate and longer-term rates also rose but at a slower pace, causing the yield curve to rise and invert. Interest rates affect banks through earnings, lending, funding costs, and the fair value of assets. This article examines the increase in interest rates in 2022 and compares the resulting changes in banking outcomes with changes that occurred during 2004 to 2006 (2004 cycle), when interest rates rose by nearly the same magnitude.

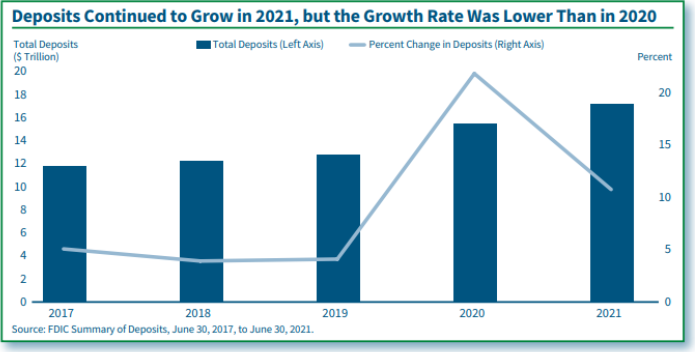

2021 Summary of Deposits Highlights

By Caitlyn Kasper, Camille Keith, Erica Tholmer and Anthony Waltrich (2022)

The 2021 Summary of Deposits data reflect the effects of the COVID-19 pandemic, changing spending patterns, and government stimulus programs on deposit levels and the number of branch openings and closures. This article evaluates changes in community banks compared with those of noncommunity banks. A special feature discusses branch openings and closings of minority depository institutions. This article also evaluates the likely effect on branch levels of increased availability and use of mobile and electronic banking applications. Responses from the 2021 Summary of Deposits survey show that deposit growth rates for the industry were higher than pre-pandemic growth rates. However, deposit growth rates have moderated compared with the record highs in 2020. Over the past year, deposit growth rates have been higher among community banks compared with those of noncommunity banks. In 2021, the decline in the number of branches accelerated from a year ago, with branches of noncommunity banks closing at a higher rate compared with that of community banks.

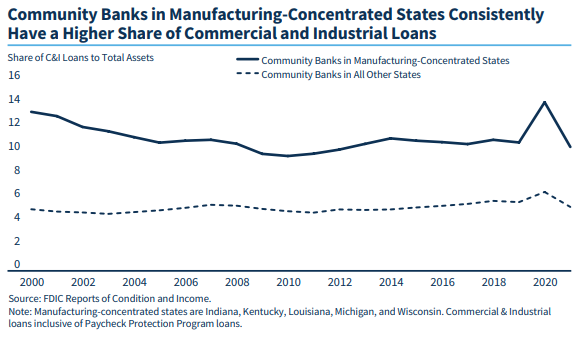

Community Bank Performance in Manufacturing-Concentrated States

By Chester Polson and Stephen Kiser (2022)

The manufacturing industry in the United States has undergone fundamental changes in recent decades. The changes are important for the communities that rely on manufacturing firms for employment and local economic growth and for the banks that offer financial services in communities where manufacturing firms have an important presence. This article highlights areas in the United States where manufacturing is most concentrated, discusses some of the long-term trends in manufacturing, and analyzes the performance of community banks in manufacturing-concentrated areas relative to community banks more broadly. The transition to advanced manufacturing has contributed to output growth even as manufacturing employment has fallen in recent decades. Community banks in manufacturing-concentrated states have provided more commercial loans than other community banks, reported higher net interest margins, and exhibited more cyclical sensitivity to economic downturns. While the manufacturing industry was negatively affected by the COVID-19 pandemic, the industry recovered much more quickly than in previous recessions, potentially brightening the outlook for community banks that support those businesses.

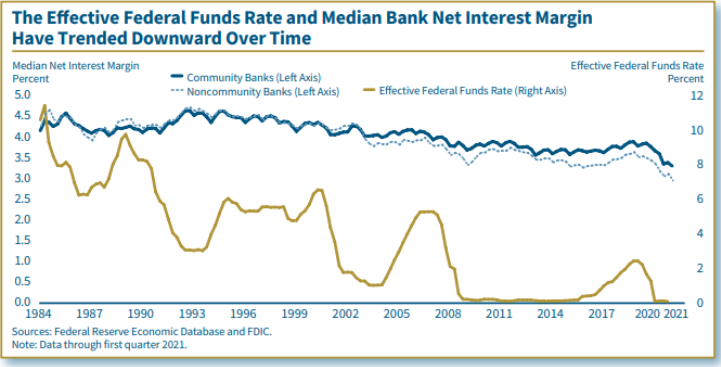

The Historic Relationship Between Bank Net Interest Margins and Short-Term Interest Rates

By Angela Hinton and Chester Polson (2021)

The years since the Great Recession generally demonstrate that protracted periods of low interest rates tend to compress net interest margin (NIM) at FDIC-insured banks. NIM decreased during the period of historically low interest rates after that recession, increased during the upward interest rate cycle between 2015 and 2019, and decreased again as interest rates fell toward zero with the onset of the COVID-19 pandemic. In most rate cycles since the 1980s, the median NIM, representative of typical banks, has moved in the same direction as changes in the federal funds rate. But this relationship has been much less pronounced for banks with high concentrations of long-term assets. Those banks with a relatively high proportion of long-term assets to total assets report greater insulation from changes in short-term interest rates. This means that their NIM falls less during downward rate cycles but rises less during upward rate cycles. The overall positive relationship between short-term interest rates and NIM and the effect of maturity structure on this relationship generally hold true over time for both community and noncommunity banks.