May 13, 1960

President Dwight D. Eisenhower signs the Bank Merger Act. This law requires that no insured bank can merge with another insured bank without prior written consent of the appropriate federal banking agency (the Office of the Comptroller of the Currency, the Federal Reserve Board, or the FDIC). These agencies are to consider the financial history and condition of each of the banks involved, their capital adequacy, future earnings prospects, the character of their management, the convenience and needs of the community to be served, and whether their corporate purposes are consistent with the Federal Deposit Insurance Act. The agencies are also to consider the effect of the merger on competition. After considering all these factors, approval is not to be granted unless the transaction is in the public interest.

July 14, 1960

President Dwight D. Eisenhower signs a law that “provides for a simpler method of determining assessments” under the Federal Deposit Insurance Act. This law simplifies the assessment process but results in many banks paying somewhat higher assessments. The law increases the assessment credit paid to banks from 60 percent to 66.66 percent.

For the text of the law, see FDIC, Annual Report, 1960, 66-72, https://www.fdic.gov/about/financial-reports/reports/archives/fdic-ar-1960.pdf .

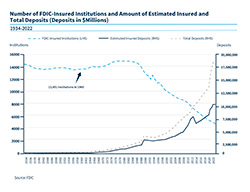

There are approximately 13,450 FDIC-insured institutions with estimated insured deposits of about $150 billion.

January 20, 1961

Erle Cocke, Sr. (1895-1977) becomes the sixth Chairman of the FDIC and serves until August 4, 1963. Before joining the FDIC, Cocke had been President of the American Bankers Association from 1966 to 1969, and over 20 years had served in various executive positions with the Fulton National Bank in Atlanta, Georgia, eventually becoming its CEO. Cocke was a financial observer at the 1964 Bretton Woods Conference that would lead to the establishment of the International Monetary Fund and post-World War II international financial relations. During the 1930s, he headed the Atlanta, Georgia, branch of the Reconstruction Finance Corporation. He served as a Georgia State Senator during the late 1920s and served overseas during World War I.

August 4, 1963

James J. Saxon, the Comptroller of the Currency, becomes Acting Chairman of the FDIC.

https://www.occ.treas.gov/about/who-we-are/history/previous-comptrollers/bio-21-james-saxon.html

January 22, 1964

Joseph W. Barr (1918-1996) becomes the seventh Chairman of the FDIC and serves until April 21, 1965. Before joining the FDIC, Barr had served as assistant for congressional relations for the Secretary of the Treasury and had been elected to Congress from Indiana, serving one term from 1969 to 1961. Before his election to Congress, Barr had engaged in various business interests. He served in senior government positions after leaving the FDIC and in 1968 was appointed Secretary of the Treasury by President Lyndon Johnson. He later became Chairman of the Federal Home Bank of Atlanta in 1977. Barr was a native of Indiana and graduated from both De Pauw and Harvard Universities. He served in the Navy from 1942 to 1945 and was awarded the Bronze Star for the sinking of a submarine.

April 21, 1965

Kenneth A. Randall (1927-2016) becomes the eighth Chairman of the FDIC and serves until March 9, 1970. At the suggestion of Senator Wallace Bennett, President Lyndon Johnson appointed Randall an FDIC Director in 1964. Before joining the FDIC, Randall had spent many years in banking, much of it at the State Bank of Provo in Provo, Utah. After leaving the FDIC, he became CEO of United Virginia Bankshares in Richmond, Virginia, and in 1976 became the President and CEO of the Conference Board. Randall was a native of Utah and received both a BA in finance and an MS in economics from Brigham Young University.

October 16, 1966

The Financial Institutions Supervisory Act of 1966 is signed into law by President Lyndon Johnson.

Until the passage of this law, the banking regulatory agencies, including the FDIC, did not have effective enforcement powers, except the draconian remedy of either closing an institution or terminating its insured status (thus effectively closing it). This law provides the banking agencies with the authority to take enforcement actions, such as issuing cease-and-desist orders, when regulators discovered that banks had engaged in unsafe and unsound practices.

The law also increases the deposit insurance coverage level to $15,000. This occurs without much debate or discussion, and is viewed basically as keeping up with general economic growth and growth in personal income and savings since 1950.

For the text of the laws see FDIC, Annual Report, 1966, 82 106, https://www.fdic.gov/about/financial-reports/reports/archives/fdic-ar-1966.pdf .

For the increase in deposit insurance coverage, see Christine M. Bradley, “A Historical Perspective on Deposit Insurance Coverage,” FDIC Banking Review 13 no.2 (2000): 1-25, https://www.fdic.gov/analysis/archived-research/banking-review/br2000v13n2.pdf .

December 23, 1969

A law increasing deposit insurance coverage to $20,000 is signed into law by President Richard M. Nixon. The increase in coverage was intended to help the thrift industry, as thrifts found themselves unable to compete with higher interest rates offered in the securities markets. Both the FDIC and Federal Home Loan Bank Board endorsed an increase to $25,000, a position that they had held even before the increase in coverage in 1966, but Congress chose a more limited increase in the coverage level.

For the increase in deposit insurance coverage, see Christine M. Bradley, “A Historical Perspective on Deposit Insurance Coverage,” FDIC Banking Review 13 no.2 (2000): 1-25, https://www.fdic.gov/analysis/archived-research/banking-review/br2000v13n2.pdf