December 31, 1990

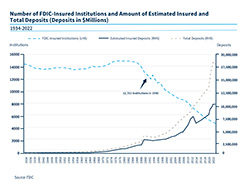

There are approximately 12,700 FDIC-insured institutions with estimated insured deposits of about $2.8 trillion.

1990

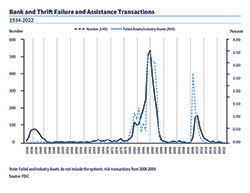

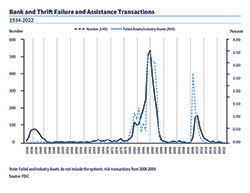

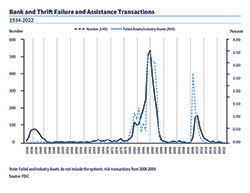

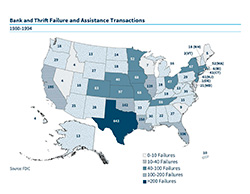

One hundred sixty-nine FDIC-insured banks and 213 thrifts for which the RTC was responsible thrifts fail in 1990. (The RTC in 1989 took over responsibility for insolvent thrifts that had been FSLIC-insured).

January 1, 1991

With the placement of the Rhode Island Share and Deposit Indemnity Corporation (the RISDIC), a private insurance fund, into conservatorship the previous day, the governor of Rhode Island closes all 45 of the credit unions and banks insured by the fund. The RISDIC had been chartered by the Rhode Island General Assembly. Beginning its operations in 1971 and intended to insure credit unions, the RISDIC's membership was expanded to other financial institutions in 1976. Many of the stronger member financial institutions left for FDIC or NCUA insurance after the failure of the Maryland and Ohio private funds in 1985, leaving weaker institutions as members. The failures of two member institutions in 1990 drained the fund and led to depositor withdrawals and eventually the RISDIC's failure.

See Thomas E. Pulkkinen and Eric S. Rosengren, “Lessons from the Rhode Island Banking Crisis,” Federal Reserve Bank of Boston, New England Economic Review, (May/June 1993), https://www.bostonfed.org/publications/new-england-economic-review/1993-issues/issue-may-june-1993/lessons-from-the-rhode-island-banking-crisis.aspx .

January 6, 1991

Bank of New England Corp. fails. The failure of Bank of New England (BNE), Boston, Massachusetts, and the BHC's other two subsidiary banks with total assets of $21.8 billion is the largest since MCorp in 1989. At the time, BNE is the 33rd largest bank in the United States. After a booming economy in the Northeast turned downward, BNE's financial condition deteriorated due largely to losses related to real estate lending, leading the OCC to close BNE and the Connecticut Bank and Trust Company. The FDIC exercised its cross-guarantee authority, leading the OCC to close the affiliated Maine National Bank as well. The resolution was notable because the FDIC, considering the region's financial condition, chose to protect all depositors, including those whose total deposits exceeded the $100,000 insurance limit.

See FDIC, Managing the Crisis, 635-651, https://www.fdic.gov/bank/historical/managing/documents/history-consolidated.pdf .

March 23, 1991

The Resolution Trust Corporation Funding Act of 1991 is signed into law by President George H.W. Bush.

The law provides an additional $30 billion in funding for the RTC; requires additional and more timely financial reporting to Congress; and calls for management reforms, including limiting the time institutions remain in conservatorship, better information systems and asset valuation processes, and better contracting systems.

https://www.fdic.gov/analysis/archived-research/banking-review/br18n3full.pdf

July 1991

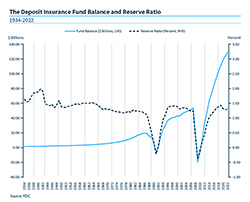

By this time, in moves designed to replenish the Bank Insurance Fund and capitalize the Savings Association Insurance Fund, the FDIC has raised assessment rates to 23 basis points for each fund.

See Lee K. Davison and Ashley M. Carreon, “Toward a Long-Term Strategy for Deposit Insurance Fund Management,” FDIC Quarterly 4, no. 4 (2010): 32, https://www.fdic.gov/analysis/quarterly-banking-profile/fdic-quarterly/2010-vol4-4/fdic-quarterly-v4n4-fundmgmt-121610.pdf .

October 17, 1991

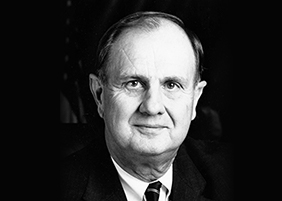

Andrew C. Hove, Jr., the FDIC's first Vice-Chairman (the FDIC's Board structure having been reconfigured by law in 1989), becomes Acting Chairman. Hove, a native of Nebraska, had been appointed Vice Chairman in 1990. Before that, he had been Chairman and CEO of the Minden Exchange Bank and Trust Company, Minden, Nebraska, having served in every department of the bank over 30 years. He was elected mayor of Minden from 1974 to 1982. Hove received a BS from the University of Nebraska, Lincoln. He would serve as Acting Chairman of the FDIC three times.

October 25, 1991

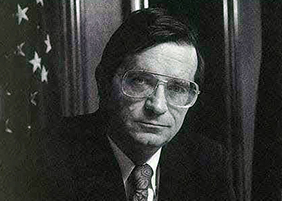

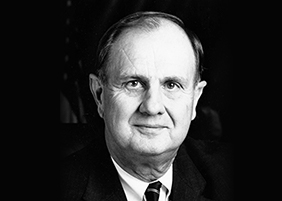

William Taylor (1939-1992) becomes the 15th FDIC Chairman and serves until August 20, 1992. Taylor, originally from Chicago, joined the Federal Reserve Bank of Chicago as an examiner; he later became Vice President in charge of lending at Upper Avenue Bank in Chicago and manager of the Chicago office of a real estate development and mortgage banking firm. Beginning in 1976, he held several increasingly senior positions at the Federal Reserve Board's Division of Banking Supervision and Regulation, becoming its Director in 1985. In 1990, he served as Acting President of the Resolution Trust Corporation Oversight Board.

December 12, 1991

The Resolution Trust Corporation (RTC) Refinancing, Restructuring, and Improvement Act of 1991 is signed into law by President George H.W. Bush.

The law:

- Provides $25 billion in new loss funds to the RTC, to be available through April, 1, 1992.

- Renames the Oversight Board the Thrift Depositor Protection Oversight Board, and expands its membership.

- Creates the position of RTC CEO, to be appointed by the President and confirmed by the Senate.

- Removes the FDIC as the exclusive manager of the RTC.

https://www.fdic.gov/analysis/archived-research/banking-review/br18n3full.pdf

December 19, 1991

The Federal Deposit Insurance Corporation Improvement Act of 1991 (FDICIA) is signed into law by President George H.W. Bush.

FDICIA:

- Puts in place supervisory reforms, in particular “prompt corrective action.” This provision requires banking regulators to develop five categories of capitalization, from “well capitalized” to “critically undercapitalized.” As an institution's capital ratio drops, the regulator must take increasingly severe action, ranging from restricting an institution's activities to closing those that remain critically undercapitalized. Another supervisory reform requires annual onsite safety-and-soundness examinations for all insured institutions (with a six-month exception for small healthy banks).

- Increases from $5 billion to $30 billion the FDIC's authority to borrow from the U.S. Treasury, and authorizes the FDIC to borrow funds for short-term working capital.

- Requires that the FDIC use the least-cost method to resolve a failed institution unless a majority of the FDIC Board of Directors and the Board of Governors of the Federal Reserve, with the agreement of the Secretary of the Treasury (in consultation with the President) decide that the failure of an institution constitutes a systemic risk. This systemic risk exception was designed to limit the so-called “too-big-to-fail” policy.

- Mandates that the FDIC put in place risk-based deposit insurance premiums by 1994.

December 31, 1991

During 1991 for the first time in the FDIC's history, the deposit insurance fund's balance, on an accounting basis, goes below zero. At year-end, it is almost negative $7 billion.

December 31, 1991

During 1991 and continuing until 1993, the FDIC for the first time in its history borrows funds from the Federal Financing Bank to address its working capital needs. FDIC borrowing will peak at about $15 billion in 1992. The FDIC repays the borrowed funds with interest.

December 31, 1991

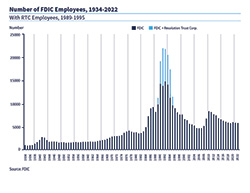

As a result of the banking and thrift crises, FDIC and RTC total staffing rises to an all-time high of 22,586.

1991

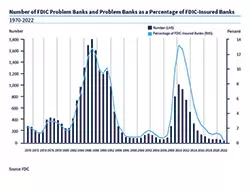

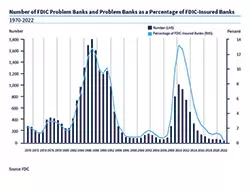

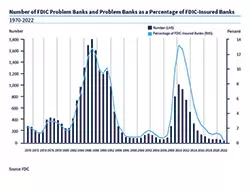

One hundred twenty-seven FDIC-insured banks and 144 thrifts for which the RTC was responsible fail in 1991. (The RTC in 1989 took over responsibility for insolvent thrifts that had been FSLIC-insured). The number of FDIC problem banks rises slightly, to 1,089.

August 20, 1992

Following the death of FDIC Chairman William Taylor, Andrew C. Hove, Jr., the FDIC's Vice Chairman, becomes Acting FDIC Chairman for the second time, this time for more than two years.

1992

One hundred twenty-two FDIC-insured banks and 59 thrifts for which the RTC was responsible fail in 1992. (The RTC in 1989 took over responsibility for insolvent thrifts that had been FSLIC-insured). The number of FDIC problem banks decreases to 856.

The FDIC's first risk-based assessment system goes into effect on a transitional basis (made permanent in 1994). It is based primarily on two measures of risk: capital levels and supervisory ratings. An institution's assessments depend on the relationship between its capital status and whether it is deemed healthy or its regulator has some level of supervisory concern about its condition as indicated by its CAMELS* rating. This system remains in effect until 2006. A shortcoming in the system was that once the deposit insurance fund was recapitalized, healthy well-capitalized institutions were by a statute that would pass in 1996, charged no premiums for deposit insurance; when banks had recovered from the crisis, this meant the vast majority of banks paid no premiums.

*Bank supervisors use CAMELS ratings to classify a bank's overall condition. The rating was originally called a CAMEL rating, with five components: “C” for capital adequacy, “A” for asset quality, “M” for management, “E” for earnings, and “L” for liquidity. In 1996, “S” for sensitivity to market risk was added. Each component is rated on a scale from 1 to 5, with 5 being the lowest rating and the highest level of supervisory concern. The bank also receives a composite rating, which generally tracks the component ratings but is not strictly an arithmetic average of the two ratings.

See https://www.fdic.gov/analysis/cfr/staff-studies/2020-01.pdf

August 10, 1993

Title III of the Omnibus Budget Reconciliation Act of 1993, national depositor preference, is enacted. Congress believed national depositor preference would result in cost savings to the FDIC and that it would lower the deficit because FDIC outlays count toward the government deficit. With no depositor preference, depositors and general creditors receive the same liquidation priority. With depositor preference, the FDIC and uninsured depositors stand before the general creditors. This law establishes a uniform order for distributing the assets of failed insured depository institutions: first, the administrative expenses of the receiver; second, secured claims; third, domestic deposits, both insured and uninsured; fourth, foreign deposits and other general creditor claims; fifth, subordinated creditor claims; and last, shareholders.

See James A. Marino and Rosalind L. Bennett, “The Consequences of National Depositor Preference,” FDIC Banking Review 12, no. 2 (1999) 19-38, https://www.fdic.gov/analysis/archived-research/banking-review/9910.pdf ; and

FDIC, Annual Report, 1993, 51, https://www.fdic.gov/about/financial-reports/reports/archives/fdic-ar-1993.pdf .

December 17, 1993

The Resolution Trust Corporation (RTC) Completion Act of 1993 is signed into law by President Bill Clinton.

The law:

- Appropriates $18.3 billion to the RTC, though only $10 billion was initially available, with the remainder available only if the RTC implemented a set of management reforms. (The agency would request only $4.6 billion and did not use all of those funds.)

- Sets the RTC's closure date on December 31, 1995, a year earlier than under FIRREA.

- Creates an RTC-FDIC Transition Task Force to ensure the orderly transfer of RTC systems and personnel to the FDIC.

https://www.fdic.gov/analysis/archived-research/banking-review/br18n3full.pdf

1993

Forty-one FDIC-insured banks and 9 thrifts for which the RTC was responsible fail in 1993. (The RTC in 1989 took over responsibility for insolvent thrifts that had been FSLIC-insured). The number of FDIC problem banks decreases further, to 472.

September 23, 1994

The Riegle Community Development and Regulatory Improvement Act of 1994 is signed into law by President Bill Clinton.

This law's provisions include requiring federal banking agencies to streamline existing regulations, work to eliminate requests for duplicative information, coordinate examinations, and simplify Call Reports. The law also amends the examination schedule mandated by FDICIA so that certain small institutions can be examined every 18 months instead of annually.

September 29, 1994

The Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994 is signed into law by President Bill Clinton.

The law provides for uniform branching and interstate acquisition rules for the entire country. These new rules include the following:

- Well-managed and well-capitalized bank holding companies could acquire banks in any state after September 29, 1995.

- Bank holding companies could merge banks in different states into a single branch network after June 1, 1997.

- States have until June 1, 1997, to choose whether to opt-out of the new law's branching provisions. Only Montana and Texas would initially decide to opt out, but both states eventually would agree to allow interstate branching.

- No bank holding company could control more than 10 percent of the nation's total deposits, or 30 percent of any single state's total deposits, unless a state elected to establish its own deposit cap above or below this 30 percent limit.

October 7, 1994

Ricki Tigert (later Ricki Helfer) becomes the 16th FDIC Chairman, the first woman to serve as Chairman and first woman to head a federal banking agency. Before joining the FDIC, Helfer had been counsel to the U.S. Senate Judiciary Committee, senior counsel for international finance at the U.S. Treasury Department, and chief international lawyer for the Federal Reserve Board. She had also served as partner in the law firm of Gibson, Dunn & Crutcher specializing in banking and finance and as Chairman of the Committee on International Banking and Finance of the American Bar Association. Helfer received a BA from Vanderbilt University, an MA from the University of North Carolina, and a law degree from the Chicago Law School.

1994

Thirteen FDIC-insured banks and 2 thrifts for which the RTC was responsible fail in 1994. (The RTC in 1989 took over responsibility for insolvent thrifts that had been FSLIC-insured). The number of FDIC problem banks decreases to 247. The banking and thrift crises of the 1980s and early 1990s end.

September 30, 1996

The Deposit Insurance Funds Act of 1996 is signed into law by President Bill Clinton.

The Savings Association Insurance Fund's (SAIF) condition had generated concern for some time. The SAIF had remained undercapitalized, and when the Bank Insurance Fund (BIF) reached its target designated reserve ratio in 1995, BIF assessment rates were reduced, causing SAIF-insured institutions to face a competitive disadvantage. This law was intended to deal with these problems.

This law imposes a one-time special assessment on SAIF-assessable deposits within 60 days (the FDIC set the assessment at 65.7 basis points, raising $4.5 billion and fully capitalizing the SAIF). The statute also separates assessments for Financing Corporation (FICO) bonds from regular SAIF assessments, and expands the FICO's assessment authority to all FDIC-insured institutions, but FICO assessment rates would be lower on BIF-assessable deposits than on SAIF-assessable deposits.

FDIC, History of the Eighties: Lessons for the Future, 132-135, https://www.fdic.gov/bank/historical/history/87_136.pdf .

https://www.fdic.gov/about/financial-reports/reports/1996/legis.html

May 26, 1998

Donna A. Tanoue becomes the 17th Chairman of the FDIC. Before joining the FDIC, Tanoue had been a partner at the law firm of Goodsill Anderson Quinn & Stifel, specializing in banking, real estate, and governmental affairs. Before that, she had been Commissioner of Financial Institutions for the State of Hawaii and Special Deputy Attorney General to Hawaii's Department of Commerce and Consumer Affairs. She received her undergraduate degree from the University of Hawaii and her law degree from Georgetown University Law Center.

November 12, 1999

The Gramm-Leach-Bliley Act (also known as the Financial Services Modernization Act of 1999) is signed into law by President Bill Clinton.

Among its provisions, this statute repeals the parts of the Banking Act of 1933 (the Glass-Steagall Act) that restricted banks affiliating with securities firms and creates a new “financial holding company” under the Bank Holding Company Act. Such companies can engage in a variety of financial activities, including insurance and securities underwriting and merchant banking.

https://www.ffiec.gov/exam/InfoBase/documents/02-con-g-l-b_summary_of_provisions-010416.pdf