DIF Balance Sheet - Second Quarter 2024

| Balance Sheet | |||||

|---|---|---|---|---|---|

| Jun-24 | Mar-24 | Quarterly Change | Jun-23 | Year-Over-Year Change | |

| Cash and cash equivalents | $77,447 | $61,042 | $16,405 | $25,353 | $52,094 |

| Investment in U.S. Treasury securities | 2,497 | 9,953 | (7,456) | 53,459 | (50,962) |

| Assessments receivable | 3,288 | 3,293 | (5) | 3,231 | 57 |

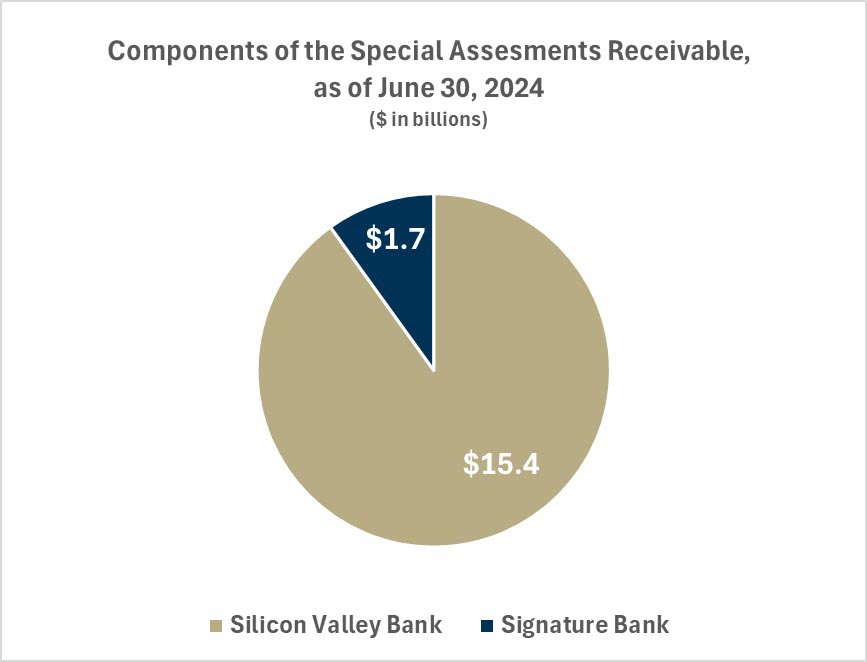

| Special Assessments receivable | 17,062 | 19,179 | (2,117) | 15,776 | 1,286 |

| Interest receivable on investments and other assets, net | 65 | 109 | (44) | 286 | (221) |

| Receivables from resolutions, net | 55,265 | 55,521 | (256) | 159,468 | (104,203) |

| Property and equipment | 306 | 315 | (9) | 366 | (60) |

| Operating lease right-of-use assets | 72 | 79 | (7) | 81 | (9) |

| Total Assets | $156,001 | $149,491 | $6,510 | $258,020 | ($102,019) |

| Accounts payable and other liabilities | 532 | 536 | (4) | 256 | 276 |

| Operating lease liabilities | 93 | 99 | (6) | 101 | (8) |

| Liabilities due to resolutions | 25,835 | 22,503 | 3,332 | 140,242 | (114,407) |

| Postretirement benefit liability | 256 | 256 | 0 | 232 | 24 |

| Contingent liability for anticipated failures | 50 | 797 | (747) | 220 | (170) |

| Contingent liability for litigation losses | 0 | 0 | 0 | 1 | (1) |

| Total Liabilities | $26,765 | $24,191 | $2,574 | $141,0562 | ($114,287) |

| FYI: Unrealized gain (loss) on U.S. Treasury securities, net | (3) | (10) | 7 | (1,007) | 1,004 |

| FYI: Unrealized postretirement benefit (loss) gain | 10 | 10 | 0 | 27 | (17) |

| Fund Balance | $129,236 | $125,300 | $3,936 | $116,968 | $12,268 |

On June 28, 2024, the FDIC received the first special assessment collection of $2.1 billion. The remainder of the receivable will be collected over the next seven quarters.

| Jun -2024 | |

|---|---|

| Silicon Valley Bank | $0.1 |

| Signature Bank | $1.0 |