"If you don't pay on the bridge, you will pay on the köprü"

Introduction

Good morning. I am delighted to be here in the enchanting city of Istanbul. I am grateful to IADI for the invitation and to the Savings Deposit Insurance Fund of Turkey for being a gracious and welcoming host.

Today, I want to share a few thoughts on one of the fundamental questions faced by all deposit insurers: How big should a deposit insurance fund be? How do we determine the optimal size of a deposit insurance fund and the appropriate target for the fund reserve ratio?

You are probably thinking: "Why now? What makes this a timely topic?"

The simple answer is that we have the opportunity. As the saying goes, "The time to repair the roof is when the sun is shining." Or at least that is what we say in America. In the place where I was born – Belgrade, Serbia, some 950 km from Istanbul – and in a nod to our hosts, there is an even more appropriate saying: "Ako ne platis na mostu, platićes na ćupriji," which literally translates to "If you don't pay on the bridge, you will pay on the köprü" – Turkish for "bridge." Put simply, whatever you call the bridge, you will pay that toll.

The FDIC has a long history in deposit fund management and pricing. Some of you may be thinking that it is easy for the FDIC to speak about the optimal size of a deposit insurance fund and the appropriate target for the fund reserve ratio. After all, our deposit insurance system has been in place for more than 85 years and our Deposit Insurance Fund (DIF) stands at $107 billion.

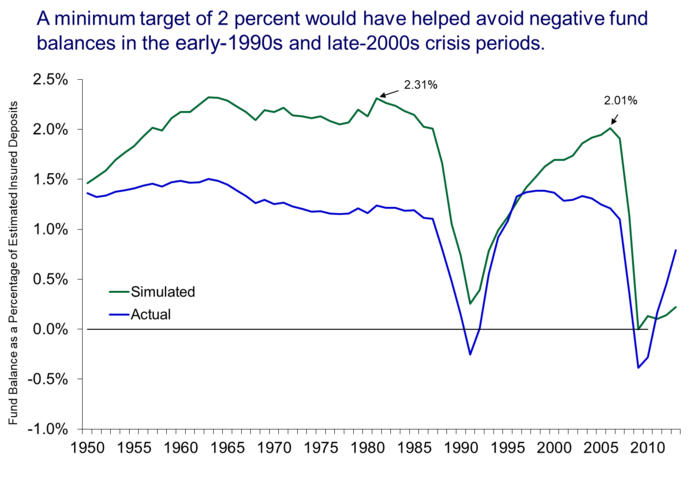

It is always difficult to raise premiums during a crisis. This is the time when insured institutions can least afford high premiums, and when the economy is most in need of cash for lending. In the years immediately following the crisis, it seemed reasonable for the FDIC to ask how we might avoid such situations. Our economists undertook a thorough historical analysis to determine what level of reserve ratio would have been required at the onset of the two crises in order to maintain both a positive fund balance and stable premiums throughout.

While it is true that the DIF is currently well funded, it has had its struggles in the past. The DIF was rendered technically insolvent during the 2008 crisis, as well as during the crisis of 1988–92. In both cases, large increases in premiums were necessary to cover insurance losses. Along those rollercoaster rides, we have learned a few lessons that I would like to share today, as well as some of our current thinking on this topic.

Ex Ante Deposit Insurance Fund: Goals and Trade-offs

The starting point is to recognize the need to establish a deposit insurance fund. If you are here today, that most likely means you agree with that basic premise.

The argument for an explicit, ex ante fund as part of any deposit insurance system is straightforward — to prevent bank runs. This is accomplished by giving depositors confidence that, in the event of a bank failure, they will be reimbursed up to the coverage limit in a timely manner. Such confidence depends on the availability of a stable funding source that will be adequate to meet the obligations of the deposit insurer. This points to the need for an explicit, ex ante fund as prescribed in IADI's own Core Principles.

Prefunding for future losses is also more fair than pay-as-you-go or ex post systems for covering losses, as these impose the costs only on surviving institutions and exacerbate the moral hazard problem. An ex ante fund also allows for steadier and more predictable premiums rather than volatile rates that rise sharply in times of economic stress when many insured institutions are already weakened.

In considering how big the fund should be, it is important to recognize a key trade-off: every dollar or euro or lira added to the deposit insurance fund above the amount necessary means one less dollar or euro or lira is available for productive lending in the economy to support economic growth and employment. On the other hand, a fund that is too small to absorb losses could result in charging procyclical assessment rates — that is, higher assessments during a time of economic stress, when banks can least afford it.

But of course, it would be imprudent to build a fund large enough to cover literally all possible loss scenarios. This would simply be too costly to society in terms of forgone economic output and job creation.

IADI's Handbook for Assessing Compliance with the Core Principles suggests that the target size of the fund should be "sufficient to participate in the resolution and payout of a number of small bank failures or several medium-sized bank failures, depending on the size and composition of the banking sector."

This recognizes that, for more extreme loss scenarios, such as a systemic crisis, it is important for the deposit insurer to have strong sources of back-up funding. In the case of the FDIC, we are authorized to borrow from several sources, including the industry itself and, as a last resort, the U.S. Treasury. Such access to taxpayer funding is the backbone of our deposit insurance system. It assures the banking public that their deposits are backed by the full faith and credit of the U.S. government. And we hope that we will not have to use it.

In 1990, the FDIC was authorized to borrow money for working capital and found it necessary to draw on that line for the first time. Cash in the fund had been replaced by illiquid assets from failed banks. Borrowings amounted to about $10 billion, and were repaid in full after a couple of years from the proceeds of asset sales.

In 2009, the FDIC was faced with a similar situation but elected not to draw on its borrowing lines to boost the DIF's liquidity. Instead, we implemented a prepaid assessment, requiring all banks to prepay an estimated three years of deposit insurance premiums.1

I recognize that the IADI suggestion on target fund size is perhaps better suited for systems like the FDIC's than for deposit insurers who lack access to reliable sources of back-up funding. Those systems should consider a funding level that is higher than the optimal ratio in order to maintain confidence in the system.

The FDIC's Post-Crisis Fund Management Plan

In the wake of the last financial crisis, the DIF was technically depleted. FDIC economists analyzed how the Fund had performed over time. Using the assessment base as defined today, and looking back to 1950, they determined that, if we had entered the two crises with a reserve ratio of at least 2 percent, the fund balance would have remained positive through both crises if the FDIC charged an average premium of about five and a quarter basis points.

This analysis became the basis for our long-range fund management plan in which we set our reserve ratio target at 2 percent of estimated insured deposits. The reserve ratio currently stands at 1.4 percent, so we have a long way to go, but our plan is to get there gradually while maintaining moderate and steady premiums over time.

The FDIC's History with Target Fund Size

Prior to 1989, the FDIC charged a flat-rate premium and did not have a reserve ratio target at all. This was a period of unusual economic stability in the United States. There were few bank failures, so there was little concern about the adequacy of the FDIC fund.

But circumstances changed dramatically during the 1980s as the U.S. experienced a large number of bank and thrift failures. Between 1980 and 1994, there were more than 2,900 failures with total losses approaching $200 billion. The deposit insurance fund for thrift institutions went bankrupt, and there were concerns over the viability of the FDIC fund. This led Congress to adopt a reserve ratio target for the first time in 1989.

The so-called "Designated Reserve Ratio," or DRR, was set at 1.25 percent of insured deposits, and this was a "hard" target. If the reserve ratio fell below 1.25 percent, the FDIC was required to return it to the target level within one year or, alternatively, charge an average premium of at least 23 basis points for as long as needed to achieve the target ratio.

In 1996, the target became even harder when Congress prohibited the FDIC from charging any premiums to well-capitalized banks with strong supervisory ratings whenever the reserve ratio was above its target level of 1.25 percent. As a result, the FDIC had virtually no flexibility to allow the reserve ratio to rise or fall.

We were in a situation with a virtually fixed reserve ratio and the possibility of highly volatile premiums, whereas previously, for more than 50 years, the FDIC had operated under a regime with a fixed premium and the possibility of a highly volatile reserve ratio.

So, the FDIC has operated on both ends of the spectrum when it comes to fund management and pricing. We are now somewhere in the middle.

Congress removed the hard-target provisions in 2006, just prior to the most recent financial crisis. Then in 2010 the Dodd-Frank Act increased the minimum reserve ratio to 1.35 percent, but there is no cap, and the FDIC Board determines the appropriate premium schedule and reserve ratio beyond the minimum requirement.

One Size Doesn't Fit All

The fund target we adopted is in the spirit of the IADI guidance, although it is more than sufficient to accommodate "a number of small failures or several medium-sized failures." Our choice reflects our particular circumstances and experience, with the U.S. having thousands of insured institutions and two recent crises, each involving hundreds of bank failures.

This is an important point. The choice of an appropriate fund target will vary across countries depending on the specific circumstances and historical experiences. A system with 40 or 50 insured institutions and little experience with bank failures will need to undertake a different analysis than the one used by the FDIC.

In that case, instead of using historical loss experience to gauge possible future funding requirements, the deposit insurer may need to tap other data sources, such as historical returns on bank assets, for projecting the possible range of future expected losses. There are a number of ways to do this. Two of our economists have drafted a useful working paper explaining the options available for deposit insurers with little failure experience to draw upon. This paper, "Determining the Target Deposit Insurance Fund: Practical Approaches for Data-Poor Deposit Insurers," is available on our website at FDIC.gov.2

And it is not only differences in the availability of data that result in different approaches to determining fund size across countries. Many circumstances will shape the set of feasible approaches available to a deposit insurer. The three key ingredients for projecting future insurance losses are: the probability of default, expected loss given failure, and the insurer's exposure at failure. All three of these can differ considerably across jurisdictions.

To take a simple example, in a system where insured institutions are funded primarily by deposits, the insurer's exposure at failure will be much higher compared to insurers in systems where banks rely on non-deposit sources of funding.

In systems where the probability of failure is likely to be higher, resulting losses will be larger, so the fund will need to be larger. If the banking industry is heavily concentrated, the fund might need to be larger because a single failure can be very costly.

As in many other areas of our deposit insurance programs, when it comes to fund adequacy there is no such thing as "one-size-fits-all."

Loss Given Failure: Ongoing Work

Before I close, I want to follow up on the topic of loss rates in bank failures. The FDIC's Center for Financial Research is currently trying to get a better understanding of the factors that determine loss rates. Our staff have developed a machine learning model to predict DIF losses based on banks' financial ratios and other characteristics, and to investigate whether this approach might improve upon the predictive power of more traditional methods.

The preliminary results are encouraging and they point to a number of drivers of high loss rates, some that are intuitive and some less so. It is too early to derive conclusions from these results today, but I wanted you to be aware about some exciting work currently underway at the FDIC that should be of interest to all deposit insurers. A better understanding of the determinants of loss rates should lead to better choices regarding the optimal size of the insurance fund. And it is possible that the target size of the insurance fund may change as our machine learning and artificial intelligence capabilities evolve to produce analytical capabilities that have been unimaginable in the past. In other words, that ratio may become dynamic and nimble.

Conclusion

I have spent most of my time today discussing different types of analysis that can inform decisions on the target reserve ratio, but my parting comment is a reminder on the limits of analytics. Ultimately, setting an appropriate target for the size of the insurance fund is a policy choice and a matter of judgment. No analysis can tell us which choice is ultimately the most prudent. The most that analysis can do is to clarify the choices available to us in statistical terms, identifying the level of confidence that a fund of a given size will be sufficient to cover its obligations.

In closing, I would like to put a human face to deposit insurance. Last year, I told you about a man who lost his life savings when a bank closed its doors and the country did not have deposit insurance. That man was my then-68-year-old father who went to work as day laborer to make sure that he and my mom could survive. Please welcome to the stage my father, now a 94-year-old. May he serve as a humble reminder of why deposit insurance matters.

The United States stands ready to provide technical assistance, training, and consulting services to foreign jurisdictions grappling with the same challenges we have faced and to help enhance the effectiveness of deposit insurance systems around the world.

It is a complicated—but crucial—process. And just remember, whatever you call the bridge, you will pay the toll. The sooner you do it, the better.

Thank you.

| 1 | The prepayment increased the FDIC's cash balances by $46 billion but not its income, since the prepayment was booked as deferred revenue, a credit in favor of the banks. For banks, it required a cash payment but no reduction in earnings or capital since banks booked the prepayment as an asset. As the FDIC invoiced banks each quarter for deposit insurance, rather than requiring a cash payment from banks, the payment was offset against their prepaid credit. Also, each quarter, the FDIC recognized the total amount invoiced as revenue, and banks expensed their prepaid asset by the amount of the quarterly invoice. |

| 2 | Available at https://www.fdic.gov/bank/analytical/cfr/2017/wp2017/cfr-wp2017-04.pdf. |