Banking Issues in Focus provides an in-depth analysis of topical banking issues. These articles range from timely analysis of economic and banking trends at the national and regional level that may affect the risk exposure of FDIC-insured institutions to research on issues affecting the banking system and the development of regulatory policy.

In the past, these articles were featured in FDIC Quarterly Volumes.

Recent Articles

Bank Lending to Nondepository Financial Institutions

By Kathryn Fritzdixon and Joycelyn Lu (2026)

Bank lending to nondepository financial institutions (NDFIs) has been the fastest-growing loan segment since the 2008-2009 Global Financial Crisis. From 2010 to 2024, outstanding balances of bank loans to NDFIs, reported quarterly on bank Consolidated Reports of Condition and Income (Call Reports), rose at a compound annual growth rate of 21.9 percent, almost three times as high as the next-fastest-growing segment. Starting in December 2024, bank regulatory agencies added additional fields to the Call Report to disaggregate bank loans to NDFIs and to collect data on unfunded commitments and performance.1 This article discusses the growth of bank lending to NDFIs and bank connections to these lenders, explains recent changes to the Call Report and trends in bank lending to NDFIs gleaned from third quarter 2025 Call Report data, and discusses the growth of NDFIs.

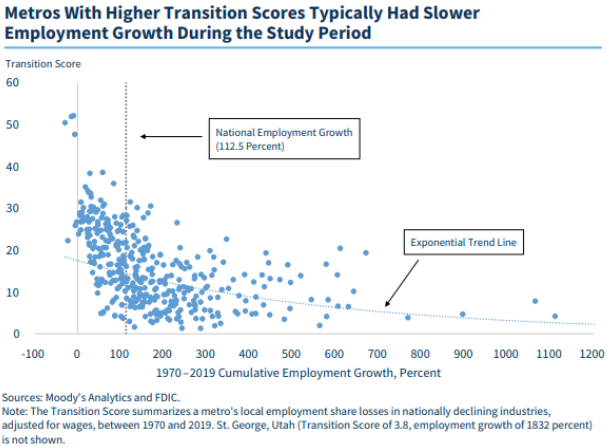

U.S. Industrial Transition and Its Effect on Metro Areas and Community Banks

By John M. Anderlik, J. Will Greene, Kathy Kalser, Eric Robbins, Scott Schweser and Brian L. Webb (2024)

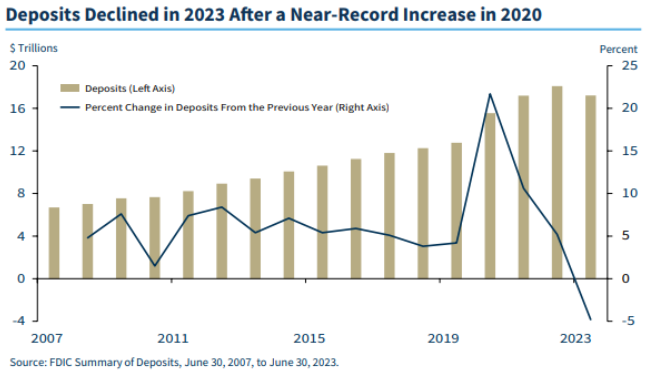

2023 Summary of Deposits Highlights

By Michael Hoffman, Camille Keith, Joycelyn Lu and LaShawn Reed-Butler (2024)

The 2023 Summary of Deposits article evaluates deposit and office trends by bank asset size group, community and noncommunity bank designation, and county type. Responses from the 2023 Summary of Deposits survey showed deposit declines of 4.8 percent between June 2022 and June 2023, the first annual decline in nearly 30 years. Deposit declines were greatest at large banks, while community banks reported deposit growth. The survey also showed the office closure rate improved from a year earlier, and community banks opened offices in metropolitan, micropolitan, and rural counties.

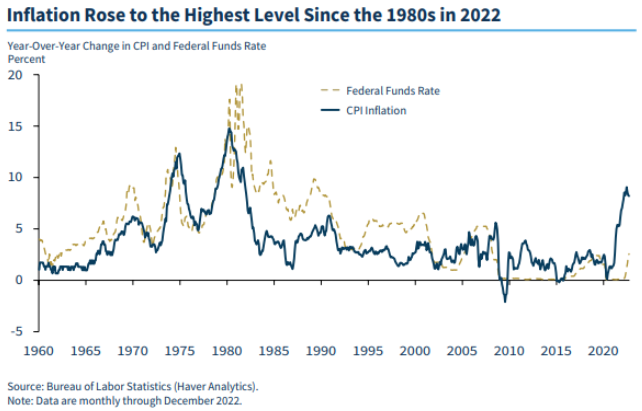

Implications of High Inflation for Banking Outcomes and Deposit Flows: Observations from 2021 to 2022 and the 1970s

By Kathryn Fritzdixon (2023)

Persistently high inflation can affect banks in various ways as monetary policy tightening and macroeconomic changes occur. This article compares lending and bank performance during the stagflation periods of the 1970s and recent high inflation with a focus on the effects on deposits. Robust deposit growth in the 1970s suggests that banks were actively seeking deposits, while in 2021 to 2022, banks generally were flush with deposits as a result of varying pandemic support programs. The differences between the two periods illustrate the importance of considering broader macroeconomic conditions when analyzing the effects of inflation on banks.

2022 Summary of Deposits Highlights

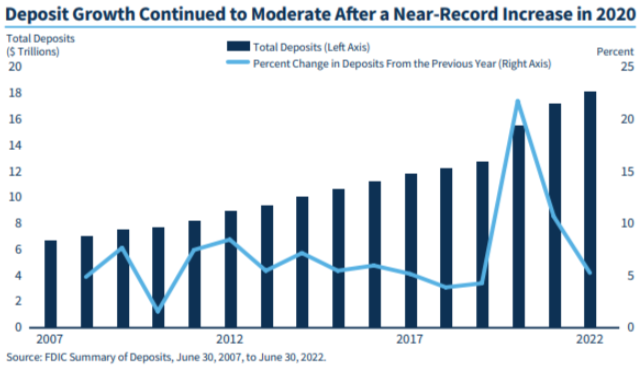

By Angela Hinton, Michael Hoffman, Caitlyn Kasper and Joycelyn Lu (2023)

The 2022 Summary of Deposits article evaluates deposit and office trends by bank asset size group, community and noncommunity bank designation, and county type. A special feature analyzes office openings and closings in locations that experienced high in- and out-migration during the COVID-19 pandemic. Responses from the 2022 Summary of Deposits survey reflected a moderation in deposit growth following extraordinary growth in 2020 and 2021. The moderation in the annual deposit growth rate came with a slight deceleration in bank office closures. More than two years since the onset of the COVID-19 pandemic, migration patterns may be influencing office locations.