FDIC-Insured Institutions Reported Net Income of $68.4 Billion in Fourth Quarter 2022

For Release

- Full–Year 2022 Net Income Was Lower Than in 2021 But Still Higher than the Pre–Pandemic Average

- Lower Noninterest Income and Higher Provisions Drove a Modest Decline in Net Income Quarter Over Quarter

- The Net Interest Margin Widened for the Third Consecutive Quarter

- Unrealized Losses on Securities Declined Quarter Over Quarter but Remain Elevated

- Broad Based Loan Growth Continued in the Fourth Quarter

- Asset Quality Metrics Remained Favorable Despite Modest Deterioration

- Community Banks Reported Increased Net Income Quarter Over Quarter

“Key banking industry metrics remain favorable at this time. Loan growth continued, net interest income grew, and asset quality measures remained favorable. Further, the industry remains well–capitalized and highly liquid”

“However, the banking industry continues to face significant downside risks from inflation, rising market interest rates, and geopolitical uncertainty that could hurt bank profitability, weaken credit quality and capital, and limit loan and deposit growth. These risks will be matters of continued supervisory attention by the FDIC over the coming year.”

— FDIC Chairman Martin J. Gruenberg

WASHINGTON— Reports from 4,706 commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reflect aggregate net income of $68.4 billion in fourth quarter 2022, a decrease of $3.3 billion (4.6 percent) from the third quarter. Lower noninterest income and higher provision expenses offset an increase in net interest income. These and other financial results for fourth quarter 2022 are included in the FDIC’s latest Quarterly Banking Profile released today.

Highlights from the Fourth Quarter 2022 Quarterly Banking Profile

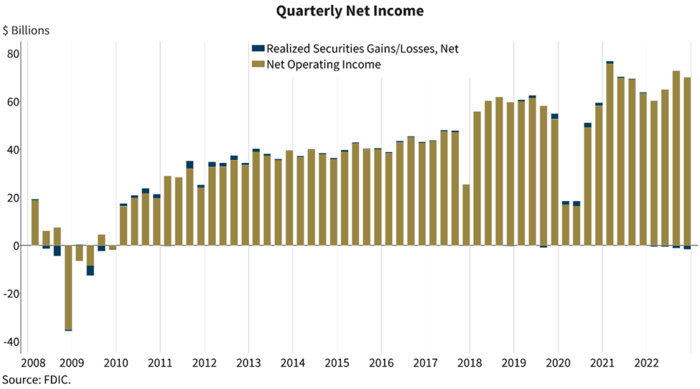

Net Income Lower Than in 2021, but Still Higher than the Pre-Pandemic Average: The banking industry reported full–year 2022 net income well above the pre–pandemic average but lower than full–year 2021 net income.1 Net income in 2022 was $263.0 billion, down $16.1 billion (5.8 percent) from 2021. The decrease was primarily attributable to higher provision expenses that offset an increase in net interest income. The aggregate return–on–assets ratio (ROA) decreased from 1.23 percent in 2021 to 1.12 percent in 2022.

Quarterly Net Income Decreased Quarter Over Quarter but Increased Year Over Year: Quarterly net income totaled $68.4 billion in fourth quarter 2022, a decrease of $3.3 billion (4.6 percent) from the third quarter. Lower noninterest income and higher provision expenses more than offset an increase in net interest income. Year–over–year net income grew $4.5 billion (7.1 percent) from fourth quarter 2021, as growth in net interest income exceeded growth in provision expense.

The banking industry reported an ROA of 1.16 percent in the fourth quarter, down from 1.21 percent in the third quarter but up from 1.09 percent in the year–ago quarter.

The Net Interest Margin Widened for the Third Consecutive Quarter: The net interest margin (NIM) increased 23 basis points from a quarter ago and 82 basis points from the year–ago quarter to 3.37 percent, above the pre–pandemic average of 3.25 percent. The year–over–year growth in the NIM was the largest reported increase in the history of the QBP.

The average yield on earning assets increased 76 basis points from third quarter 2022 to 4.54 percent due to strong loan growth and higher market interest rates. Average funding costs increased 53 basis points from the prior quarter to 1.17 percent.

Unrealized Losses on Securities Remain Elevated: Unrealized losses on securities totaled $620.4 billion in the fourth quarter, down 10.1 percent from the prior quarter. Unrealized losses on held–to–maturity securities totaled $340.9 billion in the fourth quarter. Unrealized losses on available–for–sale securities totaled $279.5 billion in the fourth quarter.

Community Bank Net Income Was Nearly Unchanged From the Prior Quarter, But Rose From a Year Ago: Community bank quarterly net income for the 4,258 community banks grew by $33.0 million (0.4 percent) from one quarter ago to $8.3 billion in fourth quarter 2022. Higher net interest income and lower losses on securities were offset by increases in noninterest expense and provisions for credit losses. Forty–seven percent of community banks reported higher net income from last quarter. Fourth quarter net income increased $1.1 billion (14.8 percent) from the year–ago quarter as higher net interest income more than offset lower noninterest income and higher noninterest expense. Seventy–one percent of community banks reported higher net income than one year ago. The community bank pretax ROA declined two basis points from one quarter ago to 1.49 percent as asset growth exceeded net income growth.

The average community bank quarterly NIM rose 7 basis points from the prior quarter and 48 basis points from the year–ago quarter to 3.71 percent. The community bank NIM is now above its pre–pandemic average of 3.63 percent. The average yield on earning assets rose 44 basis points quarter over quarter and 104 basis points year over year, while average funding costs rose 37 basis points quarter over quarter and 56 basis points year over year.

Loan Balances Increased from the Previous Quarter and a Year Ago: Total loan and lease balances increased $225.5 billion (1.9 percent) from the previous quarter. The banking industry reported growth in several loan portfolios during the quarter, including consumer loans (up $69.5 billion, or 3.5 percent) and one–to–four family residential loans (up $43.8 billion, or 1.8 percent).

Year over year, total loan and lease balances increased $979.9 billion (8.7 percent), driven by growth in commercial and industrial (C&I) loans (up $223.3 billion, or 9.7 percent), one–to–four family residential mortgages (up $220.5 billion, or 9.8 percent), and consumer loans (up $188.6 billion, or 10 percent). The annual increase in loan balances was the second largest in the history of the QBP, second to the increase last quarter .

Community banks reported a 3.7 percent increase in loan balances from the previous quarter and a 14.4 percent increase from the prior year. Growth in nonfarm, nonresidential commercial real estate and one–to–four family residential mortgage loans drove both the quarterly and annual increase in loan balances.

Asset Quality Metrics Remained Favorable Despite Modest Deterioration: Loans that were 90 days or more past due or on nonaccrual status (i.e., noncurrent loans) increased to 0.73 percent, up one basis point from the prior quarter. Noncurrent credit card and C&I loans drove the increase in the noncurrent rate. Total net charge–offs as a ratio of total loans increased 10 basis points from the prior quarter and 15 basis points from a year prior to 0.36 percent, driven by credit card, C&I, and auto loan losses. Despite the increase, the total net charge off rate remains below the pre–pandemic average of 0.48 percent. Early delinquencies (i.e., loans past due 30–89 days) increased 4 basis points from the prior quarter to 0.56 percent; one–to–four family real estate and auto loans contributed most to this growth. Total early–stage delinquencies also remain below the pre–pandemic average of 0.66 percent.

The Reserve Ratio for the Deposit Insurance Fund Rose One Basis Point to 1.27 Percent:

The Deposit Insurance Fund (DIF) balance was $128.2 billion on December 31, 2022, up $2.8 billion from the end of the third quarter. The reserve ratio increased by one basis point to 1.27 percent as insured deposits increased 1.4 percent.

Merger Activity Continued in the Fourth Quarter: Thirty–six institutions merged, three new banks opened, and no banks failed in fourth quarter 2022.

| 1 | “Pre–pandemic average” refers to the period including first quarter 2015 through fourth quarter 2019 and is used consistently throughout this document. |