SUMMARY

The FDIC recently led a rigorous evaluation of the How Money Smart Are You? suite of online financial education games which found that the resource is associated with positive effects on several important consumer financial outcomes. Users of How Money Smart Are You? adopted positive changes in financial behaviors such as budgeting and saving, and improved their subjective financial knowledge, financial skill, and financial well-being. In addition, the evaluation gathered useful insights from consumers and organizations regarding their experiences with the games.

KEY TAKEAWAYS

- A rigorous evaluation of How Money Smart Are You? linked the games to positive results for consumers across a range of outcomes, including subjective financial knowledge, financial skill, financial well-being, and, perhaps most importantly, financial behavior.

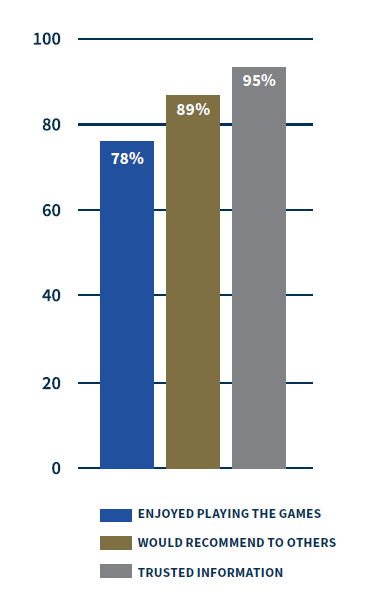

- Consumers and organizations are highly satisfied with the resource.

- Evaluation results suggest there are opportunities for practitioners to continue to innovate on financial education delivery channel options, features, and content to adapt to and evolve with user needs.

Background

Financial education is an important part of FDIC efforts to promote confidence in the banking system. Effective financial education helps people gain skills and confidence to sustain a banking relationship, achieve financial goals, and improve financial well-being.

- How Money Smart Are You? is an educational tool that provides practical knowledge to help people manage their finances with confidence, covering everyday financial topics such as earning, spending, saving, and borrowing. Offered as a complement to the FDIC’s other Money Smart financial education resources, the resource allows users to watch short videos and answer questions in a game show format to check their learning. In 2024, the resource had 3.6 million page views.

- A program evaluation was conducted to assess organizations’ and users’ experiences with the games and to measure the impact of the games on users’ financial knowledge, attitudes, behaviors, and well-being. The evaluation used multiple methods to collect both quantitative and qualitative data:

- Surveys of How Money Smart Are You? users before and after they played the games, and surveys of a comparison group of consumers that did not use the tool.1

- Focus groups with How Money Smart Are You? users.

- Survey of organizations with How Money Smart Are You? accounts.

- Interviews with organizational accountholders.

Results

Using How Money Smart Are You? is associated with positive impacts for consumers across a range of outcomes, including subjective financial knowledge, financial skill, financial well-being, and, perhaps most importantly, financial behavior.

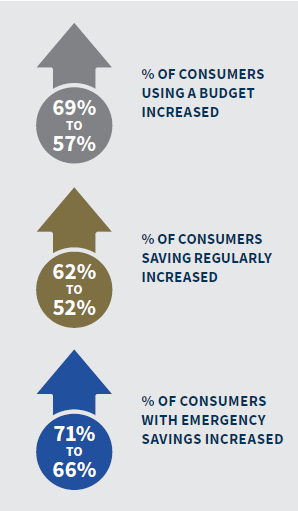

- On average, budget use increased from 57 percent to 69 percent among users after the resource was introduced.

- The share of consumers saving regularly increased from 52 percent to 62 percent after using the games.

- Emergency savings possession grew from 66 to 71 percent after playing games.

- In a regression analysis that controlled for various differences between users and non-users, the gains in behavior remained statistically significant relevant to non-users, with users demonstrating 3 times greater odds of budgeting, 8 times greater odds of saving regularly, and 5 times greater odds of having emergency savings.2

- For a number of outcomes, including having emergency savings and financial well-being, playing the games was associated with larger effects for individuals with lower baseline scores who could benefit most from financial education resources.

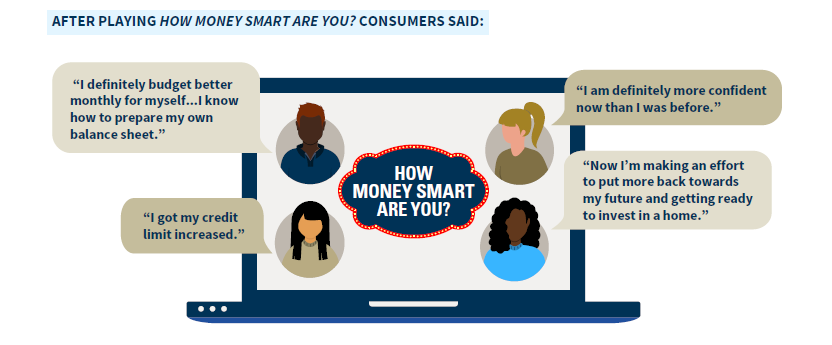

- Focus group participants frequently noted that they felt they had gained knowledge from playing How Money Smart Are You? and were more confident handling their finances. They often pointed to specific changes they had made, such as increasing their savings, keeping better track of their spending or managing credit more successfully.

- The majority of organizations surveyed (58%) said they had observed evidence that using How Money Smart Are You? had a positive impact on their clients/students.

- The evaluation of user outcomes did not find enough evidence to conclude that use of the games was associated with positive changes in participants’ objective financial knowledge or attitudes towards banks, though study limitations indicate that additional research on this topic could be useful.3 Notably, though, among organizations who had observed evidence that How Money Smart Are You? had a positive impact on students, 71% said they had seen improvements in financial knowledge.

Evaluation results suggest opportunities to enhance features, such as pacing and navigation options, that align with consumers’ and educators’ financial education needs and preferences.

- Users appreciate the ability to learn at their own pace and on their own time, and to focus on content that is most relevant and interesting to them. Consumers are often trying to fit financial education into their busy schedules, and they have a strong preference for flexible pacing and navigation options. Consumers do not want to spend time on content they have already mastered but value the ability to review content that is new or challenging.

- Both consumers and organizations expressed interest in additional content including taxes, insurance, and entrepreneurship.

OPPORTUNITIES AND BEST PRACTICES FOR STAKEHOLDERS

Monitor and Share Knowledge of Consumer Outcomes to Inform Best Practices and Help and Motivate Consumers and Financial Educators

- Demonstrating the effectiveness of financial education, including How Money Smart Are You? and other resources, can help motivate both consumers and educators to engage with financial education courses and materials. There is an ongoing need to better measure and publicize the impacts that financial education has on consumers’ financial lives. Stakeholders are encouraged to note any observable outcomes and share findings to help expand the body of knowledge regarding how and why financial education works for consumers.

- Financial institutions, educators, and organizations may choose to join the FDIC Money Smart Alliance, which offers organizational users a community to share promising approaches to financial education and a place to share feedback and learnings.

Incorporate Innovative Financial Education Delivery Channel Options, Features, and Content to Continue to Adapt to and to and Evolve with User Needs.

- The success of How Money Smart Are You? shows that consumers value online financial education that can be accessed independently, and that this channel is an effective delivery mechanism.

- There are opportunities to continue to innovate. For example, built-in, technology-based reporting tools could help educators better track students’ progress through the curricula, identify topics where additional support might be needed, and further assess program effectiveness. Building on current successful models while incorporating innovative new features will ensure that financial education continues to meet users’ evolving needs.

Susan Burhouse

Cristina Miranda

Division of Depositor and Consumer Protection, FDIC

Learn more

FDIC’s How Money Smart Are You? Games

Money Smart Alliance

Money Smart

Get engaged

Reach out to the FDIC Consumer Education staff at ConsumerEducation@fdic.gov.

Recommended citation

Susan Burhouse and Cristina Miranda, “An Evaluation of How Money Smart Are You?” (Consumer Analytic Insights, Federal Deposit Insurance Corporation, July 2025)

| 1 | The evaluation was designed as a longitudinal quasi-experimental study rather than a randomized experiment. As such, while the study shows strong associations between playing the suite of financial education games and positive consumer financial outcomes, the results cannot be conclusively determined to be causal. |

| 2 | Each outcome was analyzed using a difference-in-difference regression model, with the specific modeling approach determined by the nature of the outcome variable. Ordinary least squares regression was used for continuous and bounded continuous variables and logistic regression was used for binary outcomes. |

| 3 | There is some evidence that ceiling effects made it challenging to measure any positive effects that might exist on objective financial knowledge. |